The Community Reinvestment Act was enacted to encourage banks to help meet the credit needs in the communities in which they do business, especially low- and moderate-income communities. Join MBA Education and industry experts on Nov. 28 for an in-depth discussion on the primary changes Agencies made to the NPR in the final regulations.

Category: MBA News

MISMO Winter Summit Jan. 8-11, 2024

MISMO Summits allow you to network and collaborate with your industry colleagues while learning the latest updates on mortgage industry standards. Your participation helps make the digital future possible.

MBA DEI Playbook Member Resource

MBA and its member companies continue to make significant strides in furthering diversity, equity and inclusion (DEI) within the real estate finance industry. It is our collective mission to ensure that our industry’s workforce reflects the communities we serve.

Join the MBA Opens Doors Foundation’s #GivingTuesday Campaign

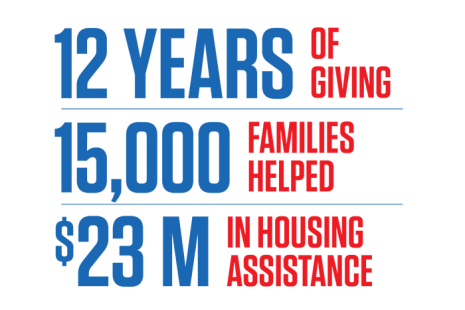

Join the MBA Opens Doors Foundation for #GivingTuesday, a global movement of generosity and kindness. On November 28, come together with industry colleagues to help keep families with critically ill or injured children in their homes. All it takes is one act of kindness at a time.

Nov. 21: NMLS Mortgage Call Report (MCR) Version 6 – What You Need to Know

The implementation of the NMLS Mortgage Call Report carries with it many changes for all MCR filers. Preparing to implement MCR Version 6 on a short timeline is an enormous challenge. Join MBA Education and industry experts from the Conference of State Bank Supervisors for tips and best practices for implementation.

MBA Education Advantage: Learn for Less

MBA Education Advantage is an annual subscription-based training that provides your organization with unlimited access to 200-plus self-studies, complimentary seats in specific courses, discounts on designations and much more.

MBA Independent Mortgage Bankers Conference, Jan. 22-24 in New Orleans. Register by Dec. 11 to Save

Join us in vibrant New Orleans for MBA’s Independent Mortgage Bankers Conference. This is the industry event of the year built for IMBs by IMBs, with a program designed exclusively for the executives and leadership teams of independent mortgage bankers of all sizes and business models. Build lasting and important relationships, hear from other IMBs, and learn meaningful solutions to make an impact for your business.

Residential Certified Mortgage Servicer (RCMS) Designation

Designed to carry you through the process of onboarding through career advancement and setting yourself apart, the Residential Certified Mortgage Servicer (RCMS) Certificate and Designation program is a comprehensive program …

Register by Dec. 11 to Save: MBA Independent Mortgage Bankers Conference, Jan. 22-24

Join us in vibrant New Orleans for MBA’s Independent Mortgage Bankers Conference. This is the industry event of the year built for IMBs by IMBs, with a program designed exclusively for the executives and leadership teams of independent mortgage bankers of all sizes and business models. Build lasting and important relationships, hear from other IMBs, and learn meaningful solutions to make an impact for your business.

School of Mortgage Banking II in Nashville in December

MBA Education’s School of Mortgage Banking II analyzes managing profitability and risk in mortgage banking. It emphasizes effective organization and management of the production, servicing and secondary marketing departments for …