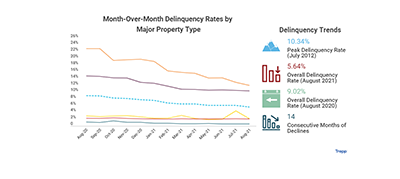

Fitch Ratings, New York, and Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate continued its steady fall in September.

Tag: Trepp

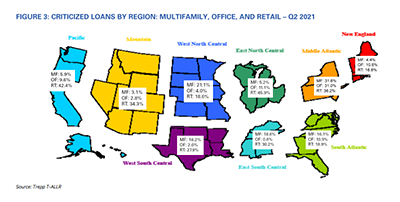

Trepp: Bank Commercial Real Estate Loan Performance ‘Not Bad, But Maybe Not That Great’

Trepp, New York, said delinquency rates for commercial real estate loans held by banks are declining after increasing modestly last year.

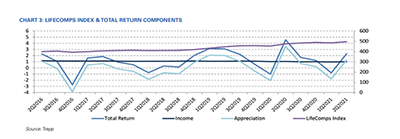

Life Insurance Commercial Mortgage Returns Bounce Back

Trepp LLC, New York, said commercial mortgage investments held by life insurance companies bounced back in the second quarter after turning negative in early 2021.

CMBS Delinquency Rate Drops Sharply

The commercial mortgage-backed securities delinquency rate declined sharply in August, posting the largest drop in six months, reported Trepp LLC, New York.

Trepp CRE Survey Finds Mix of Hope, Concern

Commercial real estate executives have a partly sunny outlook about the U.S. economy and CRE fundamentals but report some structural concerns, said Trepp LLC, New York.

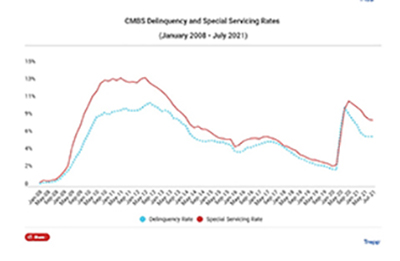

CMBS Delinquency, Special Servicing Rates Dip Again

“More of the same” was the commercial mortgage-backed securities delinquency rate headline in July, according to Trepp Senior Managing Director Manus Clancy.

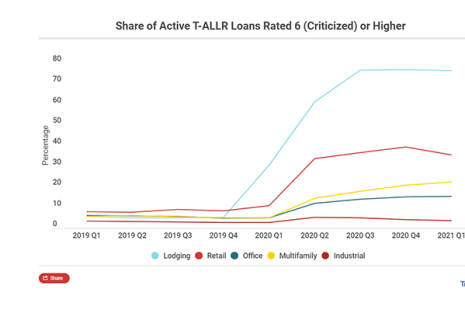

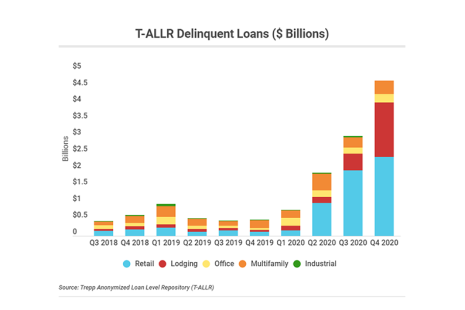

Mixed Results for CRE Bank Loan Performance

Trepp, New York, reported “mixed results” for bank commercial real estate loan performance in the first quarter.

LifeCo Commercial Mortgage Return Index Dips

Trepp, New York, said commercial mortgage investments held by life insurance companies dipped in the first quarter after three consecutive positive quarters.

CMBS Delinquencies Tick Up; Special Servicing Rate Drops

The commercial mortgage-backed securities delinquency rate and special servicing rate moved in opposite directions in April, two new reports said.

Trepp: Fourth-Quarter Bank CRE Loan Data Show ‘Elevated Distress’

The U.S. economy is well into its recovery from the pandemic recession, but Trepp LLC, New York, noted bank commercial real estate loans indicated “elevated distress” in the fourth quarter.