Trepp, New York, released its third quarter returns report for its life insurance commercial mortgage index, reporting the 2022 year-to-date return is predicted to be the lowest since Trepp started collecting LifeComps data in 1996.

Tag: Trepp

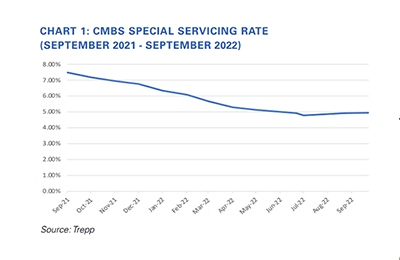

CMBS Delinquency Rate Falls; Special Servicing Rate Increases

The commercial mortgage-backed securities delinquency rate fell slightly in September, offset by an increase in the special servicing rate.

Trepp: Interest Rates Hit 2Q Life Insurance Mortgage Returns

Trepp LLC, New York, said life insurance company commercial mortgage investments fell again in the second quarter, largely due to increasing interest rates.

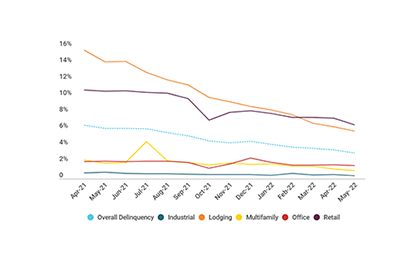

CMBS Delinquency Rate Falls Sharply

Trepp LLC, New York, said the commercial mortgage-backed securities delinquency rate posted another large decline in May.

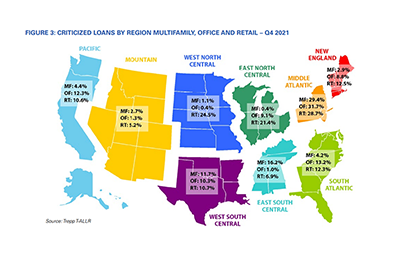

Trepp: Bank CRE Originations Up in Late 2021

Trepp, New York, reported bank commercial real estate originations rebounded in late 2021 while delinquencies continued to trend down after a moderate rise in 2020.

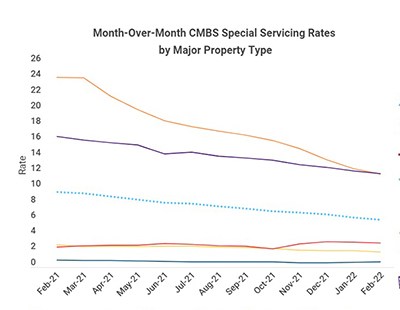

CMBS Delinquency, Special Servicing Rates Fall

The commercial mortgage-backed securities delinquency and special servicing rates both fell in February, analysts reported.

Trepp: Bank CRE Loan Originations Up, Delinquencies Down

Trepp LLC, New York, said bank commercial real estate originations rebounded in the third quarter, while delinquencies continue to trend downward after increasing modestly in 2020.

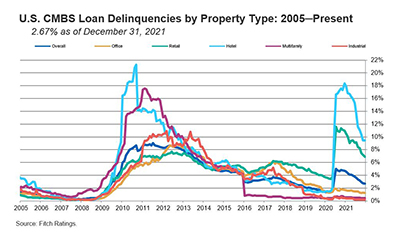

CMBS Delinquency, Special Servicing Rates Dip in December

Fitch Ratings, New York, said the commercial mortgage-backed securities delinquency rate dipped nine basis points in December to 2.67 percent, driven by robust new issuance, continued loan resolutions and fewer new delinquencies.

Trepp: Europe Leads U.S. in ESG Adoption

Environmental, Social and Governance criteria are now incorporated into corporate strategies worldwide. But the United States is falling behind Europe in the investment of ESG commercial mortgage-backed securities deals, said Trepp, New York.

CMBS Delinquency, Special Servicing Rates Fall

Trepp, New York, reported both the commercial mortgage-backed securities delinquency rate and special servicing rate dropped in November.