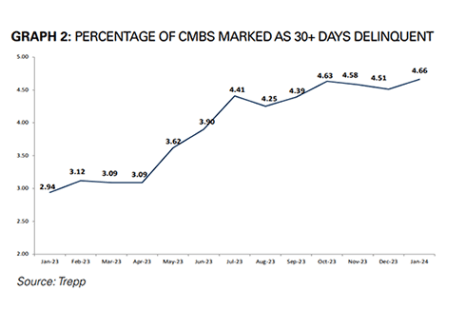

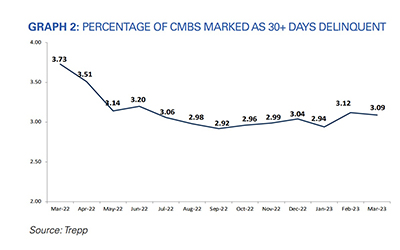

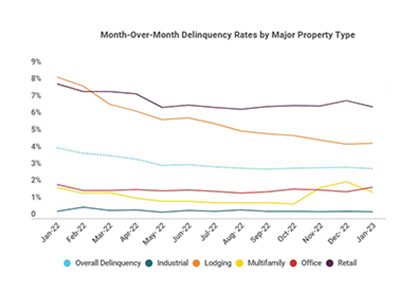

The CMBS delinquency rate rose modestly in January, increasing 15 basis points to 4.66%, according to Trepp, New York.

Tag: Trepp

Trepp: CMBS Delinquency Rate Falls in December

Trepp, New York, noted the overall commercial mortgage-backed securities delinquency rate fell by seven basis points to 4.51% in December.

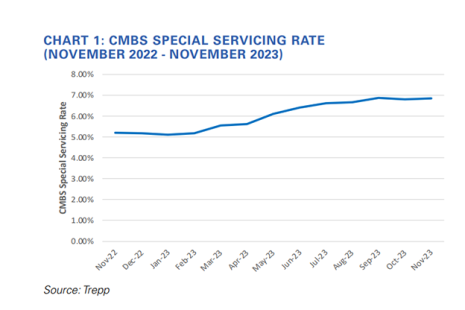

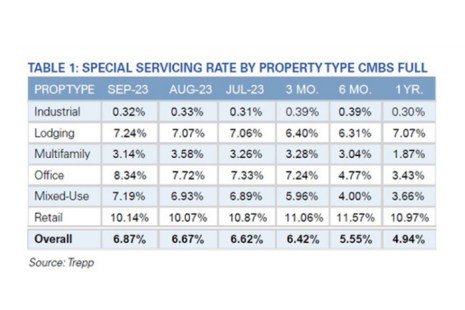

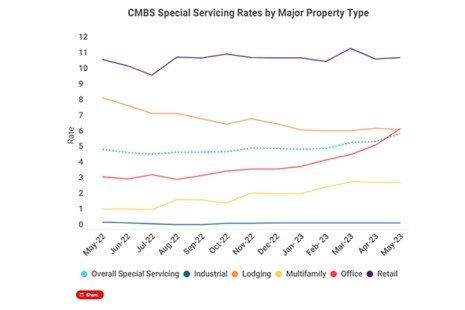

CMBS Special Servicing Rate Ticks Upward in November: Trepp

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate increased 4 basis points in November to 6.84%.

Trepp: Special Servicing Rate Climbs in September

Trepp, New York, reported the CMBS Special Servicing Rate increased by 20 basis points in September, up to 6.87%.

Trepp: CMBS Special Servicing Rate Rises to 6.11%

Trepp, New York, reported its CMBS Special Servicing Rate climbed 49 basis points to 6.11% in May, marking its fourth sequential monthly increase.

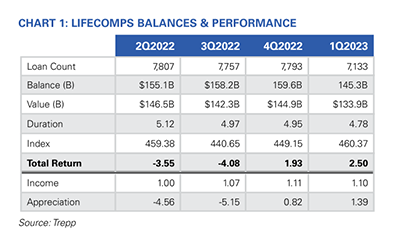

Trepp: Positive Q1 for Insurance Company Commercial Mortgages, But Office Sector Concerns

Trepp, New York, said its LifeComps index of insurance company commercial mortgage investments in the first quarter saw a total return of 2.5% in the first quarter, with a 1.4% contribution from price appreciation.

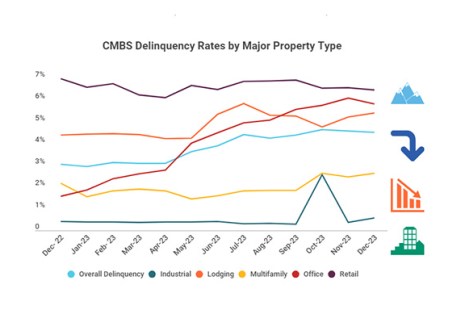

CMBS Delinquency Rate Dips; Offices See Increase

The commercial mortgage-backed securities delinquency rate fell slightly in March, but the segment that everyone watches closely–office–saw its rate move higher again, reported Trepp, New York.

Trepp: 2022 Life Insurance Mortgage Returns Worse Than 2008

Trepp LLC, New York, said its life LifeComps index of insurance company commercial mortgage investments saw a -10.1% return in 2022, largely due to a -14.3% appreciation return.

January CMBS Delinquency Rate Falls Below 3%

Trepp, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell 10 basis points in January to 2.94%.

CMBS Delinquency, Special Servicing Rates Increase

The commercial mortgage-backed securities delinquency and special servicing rates both increased in November, according to Trepp LLC and DBRS Morningstar.