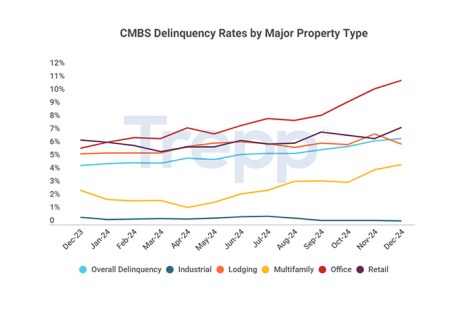

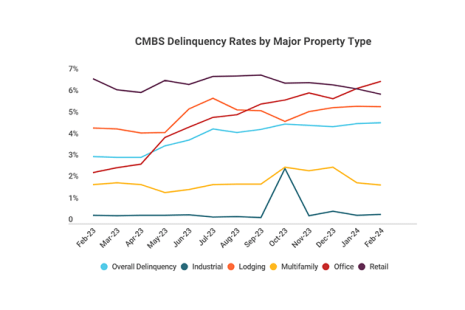

Trepp, New York, found the CMBS Delinquency Rate fell in February, with the overall rate decreasing 26 basis points to 6.3%.

Tag: Trepp

Location, Location, Location: Expert Insights on Property Markets

SAN DIEGO–Every commercial property sector has seen both challenges and opportunities since the pandemic. Five real estate executives gathered here at MBA’s Commercial/Multifamily Finance Convention and Expo to share their thoughts.

Trepp Reports CMBS Delinquency Rate Rises Again in December

Trepp, New York, reported its CMBS delinquency rate rose in December, with the overall rate up 17 basis points to 6.57%.

Trepp: CMBS Delinquency Up in November

Trepp, New York, reported the CMBS delinquency rate grew 42 basis points to 6.4%.

CMBS Special Servicing Rate Leaps in August, Trepp Finds

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate jumped in August, climbing 16 basis points to 8.46%.

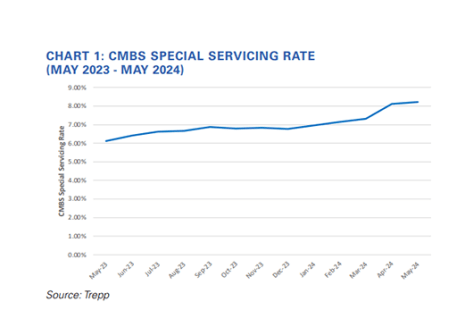

Trepp Reports CMBS Special Servicing Rate Increases Again

The commercial mortgage-backed securities special servicing rate continues to grow, increasing 10 basis points in May to 8.21%, according to Trepp, New York.

Trepp Reports CMBS Delinquency Rate Dips

Trepp, New York, reported the commercial mortgage-backed securities delinquency rate dipped back below 5% in May.

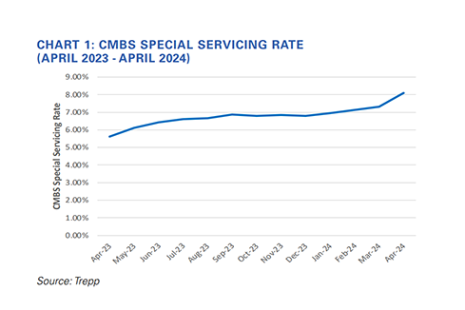

Trepp: CMBS Special Servicing Rate Jumps in April

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate “leaped” in April, rising 80 basis points to 8.11%.

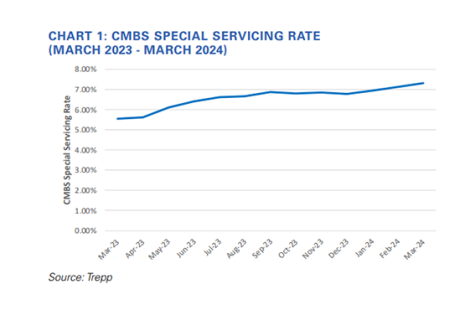

CMBS Special Servicing Rate Jumps: Trepp

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate jumped 17 basis points in March to 7.31%.

Office Sector Drives CMBS Delinquency Rate Up Slightly: Trepp

The delinquency rate for commercial mortgage-backed securities inched upward in February, according to Trepp, New York.