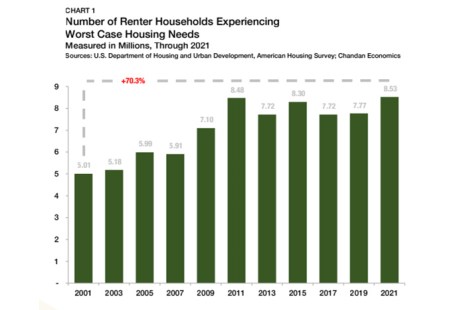

The Low-Income Housing Tax Credit (LIHTC) program has long been one of the most important tools for creating affordable housing across the United States. However, recent years have seen significant challenges in ensuring the equitable distribution of LIHTC equity, raising concerns among developers, investors, and policymakers alike.

Tag: LIHTC

Commercial/Multifamily Briefs, June 13, 2024

Commercial and multifamily industry news from Greystone and JLL.

MBA Opposes Biden Administration’s Rent Control Proposal on LIHTC-Financed Multifamily Properties

MBA President and CEO Bob Broeksmit, CMB, released a statement on the Biden administration’s planned announcement to impose a 10% limit on annual rent hikes at properties supported by the Low-Income Housing Tax Credit (LIHTC).

Bob Broeksmit Lays Out Important Items on MBA’s Radar to Kick Off National Advocacy Conference

WASHINGTON–As Mortgage Bankers Association members take to the nation’s capital–and U.S. Capitol Building–to share the industry’s story with lawmakers and hear from legislative stakeholders via the National Advocacy Conference, key policy and regulatory topics such as Basel III endgame, housing supply and HUD Secretary Marcia Fudge stepping down are top of mind.

MBA Announces Support for H.R. 7024, the Tax Relief for American Families and Workers Act of 2024

On Jan. 16, Sen. Ron Wyden, D-Ore., and Rep. Jason Smith, R-Mo., released H.R. 7024, the Tax Relief for American Families and Workers Act of 2024. The Mortgage Bankers Association strongly supports the bipartisan, bicameral bill.

Affordable Housing Vital as 4% LIHTC Utilization Reaches New High, Arbor Reports

Arbor Realty Trust, Uniondale, N.Y., released its Affordable Housing Trends Report for Fall 2023, finding that utilization of the 4% Low-Income Housing Tax Credit has reached a new high, among other notable takeaways.

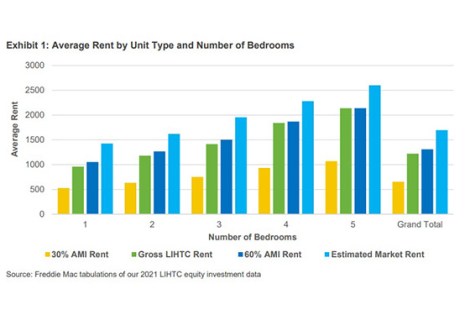

Former LIHTC Properties Remain Affordable, Freddie Mac Says

Multifamily properties that exit the Low-Income Housing Tax Credit program generally continue to rent at levels lower than those charged in the broader market, reported Freddie Mac Multifamily, McLean, Va.

Quote

“A fear has been that LIHTC properties would simply jack up rents to the top of the market at the expiration of their rent and income restrictions, generally about 30 years, but that’s not usually the case.”

–Steve Guggenmos, Vice President of Research & Modeling with Freddie Mac, McLean, Va.

Nov. 30: Rental Housing Perspectives: Low-Income Housing Tax Credit Landscape

Government tax-incentive programs for multifamily affordable housing create an opportunity set for investors, developers and lenders. In particular, the syndication of Low-Income Housing Tax Credits is a fundamental tool which contributes to the development of new affordable housing as well as the rehabilitation of existing affordable housing.

Affordable Housing Vacancy Rates Remain Tight

The national vacancy rate for Low-Income Housing Tax Credit-supported affordable housing dipped 0.1 percent in the second quarter to 2.5 percent, said Moody’s Analytics REIS, New York.