Commercial mortgage delinquencies increased in the first quarter of 2024, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.

Tag: Jamie Woodwell

Offices, Insurance Top Commercial Servicing Conversations, Panel Says

NEW ORLEANS–Looking at servicing in the current commercial market, offices and insurance issues are top of mind. That’s per a panel at the Mortgage Bankers Association Commercial/Multifamily Finance Servicing and Technology Conference, here, May 20.

Commercial/Multifamily Borrowing Unchanged in First Quarter of 2024

Commercial and multifamily mortgage loan originations were essentially unchanged in the first quarter of 2024 compared to a year ago, and decreased 23% from the fourth quarter of 2023, according to the Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

MBA: Total Commercial Real Estate Borrowing and Lending Declined 47% in 2023

Total commercial real estate (CRE) mortgage borrowing and lending is estimated to have totaled $429 billion in 2023, a 47% decrease from the $816 billion in 2022, and a 52% decrease from the record $891 billion in 2021.

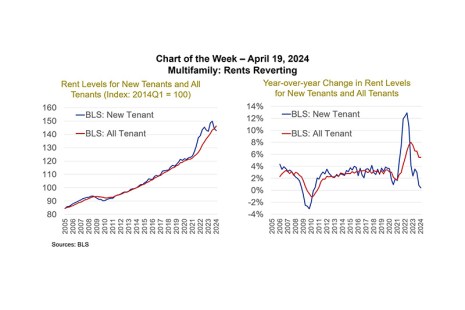

MBA Chart of the Week–Multifamily: Rents Reverting

The pandemic did a number on the housing market.

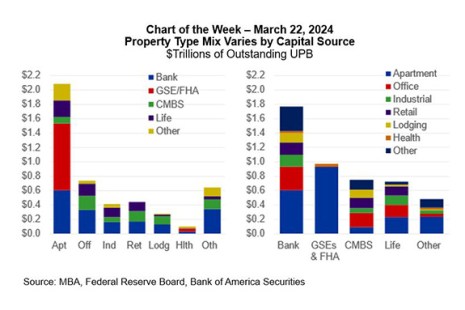

MBA Chart of the Week: CRE Mortgage Debt Across Capital Sources, Property Types

This week’s Chart of the Week shows MBA’s estimates of the distribution of CRE mortgage debt across capital sources and property types and is derived from a variety of public and private sources.

MBA: Commercial and Multifamily Mortgage Delinquency Rates Increased in Fourth Quarter 2023

Commercial mortgage delinquencies increased in the fourth quarter of 2023, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.

MBA: Commercial and Multifamily Mortgage Debt Outstanding Increased in Fourth Quarter

The level of commercial and multifamily mortgage debt outstanding at the end of 2023 was $130 billion (2.8%) higher than at the end of 2022, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

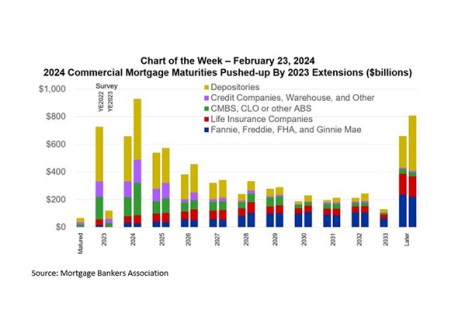

MBA Chart of the Week: 2024 Commercial Mortgage Maturities Pushed Up by 2023 Extensions

Commercial mortgages tend to be relatively long-lived, spreading maturities out over several years.

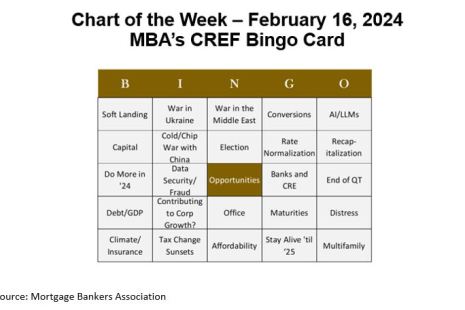

Chart of the Week: MBA’s CREF Bingo Card

Many of us recently returned from a week in San Diego at MBA’s Commercial Real Estate/Multifamily Finance Convention and Expo, where 2,000-plus CRE mortgage professionals gathered to hear from speakers, discuss policy issues, network, and – most importantly – begin the year’s deal-making in earnest.