Commercial and multifamily mortgage performance remains mixed, revealing the various impacts the COVID-19 pandemic has had on different types of commercial real estate, according to two reports released today by the Mortgage Bankers Association.

Tag: Jamie Woodwell

MBA Chart of the Week: Commercial/Multifamily Property Sales & Mortgage Originations

Commercial and multifamily mortgage origination volumes tend to move nearly in lockstep with property sales activity. With the onset of the COVID-19 pandemic, both tumbled, but with some important caveats.

MBA Forecast: 2020 Commercial/Multifamily Lending Down 34% from 2019 Record Volumes

Commercial and multifamily mortgage bankers are expected to close $395 billion of loans backed by income-producing properties in 2020, a 34 percent decline from 2019’s record $601 billion, according to a new Mortgage Bankers Association forecast.

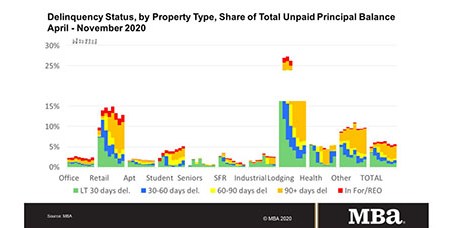

Commercial, Multifamily Mortgage Delinquencies Decline in October

Delinquency rates for mortgages backed by commercial and multifamily properties declined in October, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.

Commercial, Multifamily Borrowing Falls 47% in Third Quarter

Commercial and multifamily mortgage loan originations were 47 percent lower in the third quarter compared to a year ago, and increased 12 percent from the second quarter of 2020, the Mortgage Bankers Association reported.

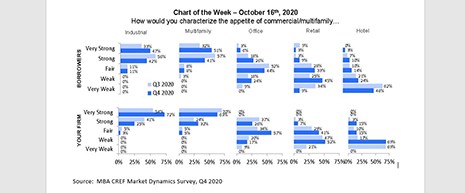

MBA Chart of the Week: Appetite for Commercial and Multifamily

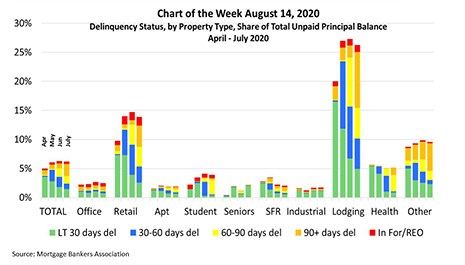

One of the most striking aspects of the pandemic’s impact on commercial real estate markets is the markedly disparate impact it is having on different property types.

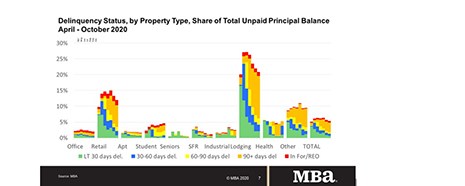

MBA: September Commercial, Multifamily Mortgage Delinquencies Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties declined in September, the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey reported.

MBA: 2Q Commercial/Multifamily Mortgage Debt Rises

The Mortgage Bankers Association’s latest quarterly Commercial/Multifamily Mortgage Debt Outstanding report found commercial and multifamily mortgage debt outstanding rose by $43.6 billion (1.2 percent) in the second quarter.

MBA Chart of the Week: Retail E-Commerce/Retail Sales

When real estate professionals discuss the impacts of the COVID-19 pandemic

on commercial real estate, their comments generally come in one of four themes.

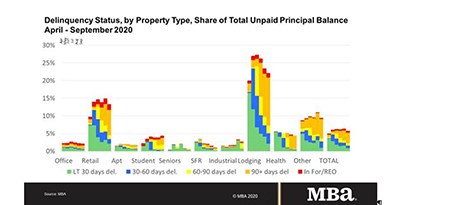

MBA Chart of the Week: Delinquency Rate for Commercial/Multifamily Mortgages

The delinquency rate for commercial and multifamily mortgages declined in July. The rate had increased sharply in April at the onset of the pandemic, with 3.6% of loan balances becoming newly delinquent. In May, delinquencies increased again, with a new, but smaller, cohort of newly delinquent loans (2.8%) and slightly more than half of the balance of loans that had been less than 30-days delinquent in April moving to the 30-60 days delinquent category. The inflow of newly delinquent loans continued to slow in June (1.8% of overall balances) and July (1.4%).