Commercial/multifamily mortgage debt outstanding increased by $60.7 billion (1.5 percent) in the second quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding report.

Tag: Jamie Woodwell

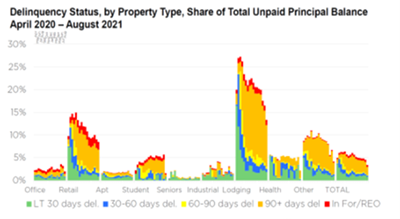

MBA: Commercial, Multifamily Delinquencies Continue Downward Trend

Delinquency rates of mortgages backed by commercial and multifamily properties have broadly improved in recent months, according to two new Mortgage Bankers Association reports.

MBA: Second Quarter Commercial/Multifamily Borrowing Bounces Back

Commercial and multifamily mortgage loan originations jumped by 106 percent in the second quarter from a year ago and increased by 66 percent from the first quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

MBA: 2021 Commercial/Multifamily Lending to Increase 31% to $578 Billion

Commercial and multifamily mortgage bankers are expected to close $578 billion in loans backed by income-producing properties in 2021, a 31 percent increase from 2020’s volume of $442 billion, according to a new forecast from the Mortgage Bankers Association.

MBA: Multifamily Lending Hits $360 Billion in 2020

Last year 2,140 different multifamily lenders provided a total of $359.7 billion in new mortgages for apartment buildings with five or more units, the Mortgage Bankers Association reported.

Commercial and Multifamily Mortgage Delinquencies Declined in July

Delinquency rates for mortgages backed by commercial and multifamily properties declined in July, the Mortgage Bankers Association’s latest CREF Loan Performance Survey reported.

CRE Market Sentiment Improves to 2015 Level

CRE executives’ market sentiment has improved dramatically from a year ago, reported RCLCO, Washington, D.C.

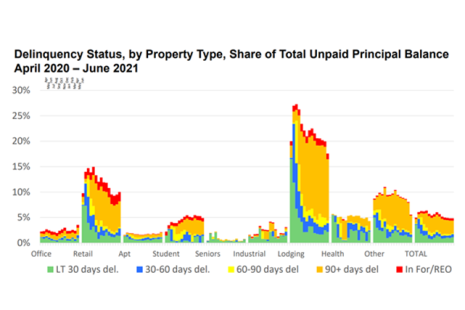

June Commercial, Multifamily Mortgage Delinquencies Hold Steady

Delinquency rates for mortgages backed by commercial and multifamily properties held steady in June, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey said.

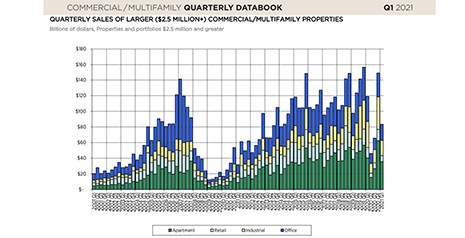

MBA Releases Q1 Commercial/Multifamily DataBook

On Wednesday, the Mortgage Bankers Association released its first quarter Commercial/Multifamily DataBook.

MBA: 1st Quarter Commercial/Multifamily Mortgage Debt Up 1.1%

Commercial and multifamily mortgage debt outstanding rose by $44.6 billion (1.1 percent) in the first quarter, the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding report said.