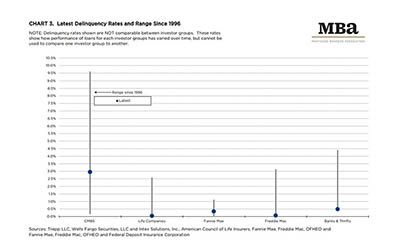

Commercial and multifamily mortgage delinquencies declined in the second quarter, the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report said.

Tag: Jamie Woodwell

MBA: 2Q Commercial/Multifamily Mortgage Delinquency Rates Decline

Commercial and multifamily mortgage delinquencies declined in the second quarter, the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report said.

MBA White Paper: Office Market ‘Likely Changed Forever’

The ongoing tug of war between employers and employees about returning to the office will accelerate as pandemic-related impacts fade, according to a new Mortgage Bankers Association white paper.

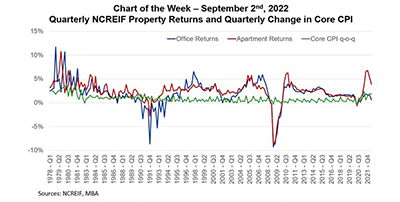

MBA Chart of the Week: Quarterly NCREIF Property Returns

Federal Reserve Board Chair Jerome Powell warned at Jackson Hole, Wyo., last month, “Inflation is running well above 2 percent, and high inflation has continued to spread through the economy. While the lower inflation readings for July are welcome, a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down.”

Quote

“The forward path of inflation remains a topic of great debate and conjecture. How that path plays into the relative benefits of different investment options–including commercial real estate and other real assets–will give us even more insights into the relationship.”

–Jamie Woodwell, MBA Vice President of Commercial Real Estate Research

MBA: Commercial/Multifamily Borrowing Up 19 Percent Year-Over-Year

Commercial and multifamily mortgage loan originations increased by 19 percent in the second quarter from a year ago, the Mortgage Bankers Association said Thursday in its Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

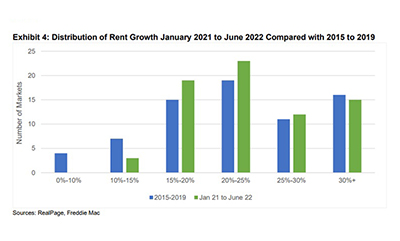

Multifamily Sector Fundamentals Could Moderate

After six months of healthy growth in multifamily fundamentals, Freddie Mac, McLean, Va., said the sector’s growth could moderate through the remainder of 2022.

MBA: 2021 Multifamily Lending Hits Record $487 Billion

Multifamily lenders provided a record $487.3 billion in new apartment buildings with five or more units, the Mortgage Bankers Association reported Tuesday.

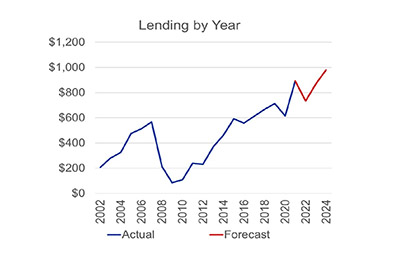

MBA Forecast: Higher Rates, Economic Uncertainty to Slow Commercial/Multifamily Lending

Total commercial and multifamily mortgage borrowing and lending could fall to $733 billion this year, down 18 percent from 2021 totals, according to an updated baseline forecast from the Mortgage Bankers Association.

MBA Forecast: Higher Rates, Economic Uncertainty to Slow Commercial/Multifamily Lending

Total commercial and multifamily mortgage borrowing and lending could fall to $733 billion this year, down 18 percent from 2021 totals, according to an updated baseline forecast from the Mortgage Bankers Association.