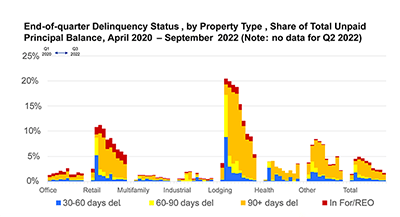

“The delinquency rate for mortgages backed by commercial and multifamily properties remained low at the end of the third quarter. For example, the share of bank-held CRE loan balances that were delinquent has only been lower once–just before the onset of the COVID-19 pandemic–in the series’ 30-year history.”

–Jamie Woodwell, MBA Head of Commercial Real Estate Research.