Total commercial real estate mortgage borrowing and lending fell to $816 billion in 2022, an 8 percent decrease from the record $891 billion in 2021 but a 33 percent increase from $614 billion in 2020, the Mortgage Bankers Association reported Thursday.

Tag: Jamie Woodwell

MBA: 2022 Commercial and Multifamily Lending Down 8 Percent

Total commercial real estate mortgage borrowing and lending fell to $816 billion in 2022, an 8 percent decrease from the record $891 billion in 2021 but a 33 percent increase from $614 billion in 2020, the Mortgage Bankers Association reported Thursday.

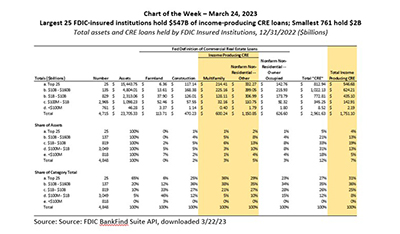

MBA Chart of the Week, Mar. 30, 2023: CRE Loans/FDIC-Insured Institutions

There is, not inappropriately, a great deal of attention being paid to commercial real estate right now. And with that attention come a lot of different questions and answers—with many answers varying depending on how one defines things.

MBA Releases 2022 Rankings of Commercial/Multifamily Mortgage Firms’ Origination Volumes

The following firms were the top commercial/multifamily mortgage originators in 2022, according to a set of commercial/multifamily real estate finance league tables prepared by the Mortgage Bankers Association:

MBA: 4Q Commercial, Multifamily Mortgage Debt Outstanding Up By $324B

Commercial/multifamily mortgage debt outstanding at year-end 2022 rose by $324 billion (7.7 percent) from the previous year, the Mortgage Bankers Association’s latest quarterly Commercial/Multifamily Mortgage Debt Outstanding Report said.

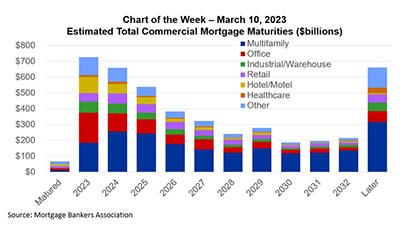

MBA Chart of the Week March 16 2023–Estimated Total Commercial Mortgage Maturities

At MBA’s CREF Convention in San Diego last month, we released the results of our annual survey of upcoming commercial and multifamily mortgage maturities. The survey collects information directly from loan servicers on when the loans they service mature.

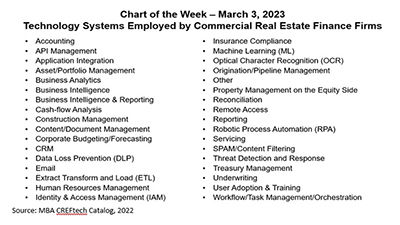

MBA Chart of the Week: Tech Systems Employed by Commercial Real Estate Finance Firms

Lenders closed $800 billion in mortgages backed by income-producing commercial and multifamily properties in 2022–adding to what is now almost $4.4 trillion in outstanding loans.

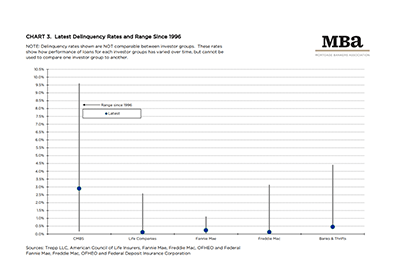

MBA: 4Q Commercial, Multifamily Mortgage Delinquency Rate Remains Low

Commercial and multifamily mortgage delinquencies remained low in the fourth quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report.

#MBACREF23: 2023 Commercial/Multifamily Borrowing, Lending Expected to Fall to $684B

SAN DIEGO–The Mortgage Bankers Association said total commercial and multifamily mortgage borrowing and lending is expected to fall to $684 billion this year, a 15 percent decline from an expected 2022 total of $804 billion.

#MBACREF23: 2023 Commercial/Multifamily Mortgage Maturity Volumes Up 33 Percent

SAN DIEGO–The Mortgage Bankers Association said $331.2 billion of the $2.8 trillion (12 percent) of outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2023, a 33 percent increase from the $249 billion that matured in 2022.