The Federal Housing Finance Agency, Washington, D.C., decreased the 2023 multifamily loan purchase caps for Fannie Mae and Freddie Mac slightly to $75 billion each.

Tag: FHFA

MBA Commends FHFA’s New Enterprise Housing Goals Methodology Proposal

The Mortgage Bankers Association commended the Federal Housing Finance Agency for its proposed rule establishing 2023-2024 Multifamily Enterprise Housing Goals for Fannie Mae and Freddie Mac.

FHFA Proposes 2023-2024 Fannie Mae, Freddie Mac Multifamily Housing Goals

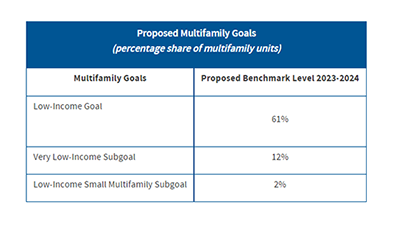

The Federal Housing Finance Agency on Tuesday proposed new benchmark levels for Fannie Mae and Freddie Mac multifamily housing goals in 2023 and 2024.

FHFA, GSEs Detail Equitable Housing Finance Plans

The Federal Housing Finance Agency on Wednesday offered details of the government-sponsored enterprises’ Equitable Housing Finance Plans for 2022-2024.

FHFA Releases GSE 2021 Mission Report

The Federal Housing Finance Agency released its annual Mission Report that describes Fannie Mae, Freddie Mac and Federal Home Loan Bank activities to increase access to financing for economic development and affordable, equitable and sustainable housing.

FHFA Announces GSEs’ Duty to Serve Plans for 2022-2024

The Federal Housing Finance Agency published the 2022-2024 Underserved Markets Plans for Fannie Mae and Freddie Mac under the Duty to Serve Program, which outline the government-sponsored enterprises’ commitment to serving manufactured housing, affordable housing preservation and rural housing.

The FHFA 2022-2026 Strategic Plan: What It Means for MBA Members

The Federal Housing Finance Agency last week released its 2022-2026 Strategic Plan for Fiscal Years 2022-2026, focusing on guiding Fannie Mae, Freddie Mac and the Federal Home Loan Bank System for the next five years.

FHFA Seeks Input on FY2022-2026 Strategic Plan

The Federal Housing Finance Agency asked for input on its Draft Strategic Plan, which outlines the Agency’s priorities for the coming years as regulator of the Federal Home Loan Bank System and as regulator and conservator of Fannie Mae and Freddie Mac.

FHFA Finalizes 2022-2024 Single-Family, 2022 Multifamily Housing Goals

The Federal Housing Finance Agency released benchmark levels for Fannie Mae and Freddie Mac single-family housing goals for 2022 through 2024 and benchmark levels for multifamily housing goals for 2022.

FHFA Increases Fannie Mae, Freddie Mac Multifamily Loan Purchase Caps

The Federal Housing Finance Agency, Washington, D.C., increased the 2022 multifamily loan purchase caps for Fannie Mae and Freddie Mac to $78 billion each.