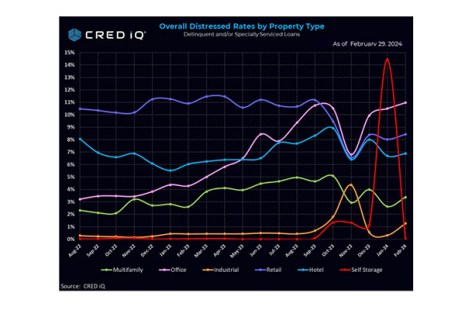

CRED iQ, Wayne, Pa., reported the Distress Rate for all property types trimmed 4 basis points in February to 7.35%. However, the multifamily distress rate was up 80 basis points–the largest monthly increase in that sector in more than a year and a half.

Tag: Distressed Debt

Priced to Perfection: Commercial Real Estate Values Inch Up

As the anniversary of COVID significantly impacting the U.S. and commercial/multifamily property markets passes, challenging questions about property values remain top of mind.

A Bridge Over Troubled Water: Debt Funds and Mortgage REITs Come of Age

COVID-19 has negatively impacted industries across the U.S., with commercial real estate and its financiers no exceptions.

Distressed Debt Monitor: A Conversation with Mayer Brown Partner Jeffrey O’Neale

MBA NewsLink interviewed Jeffrey O’Neale, a partner in Mayer Brown’s Charlotte, N.C., office and a member of the Real Estate Markets practice, about hotel sector workouts and other distressed debt.