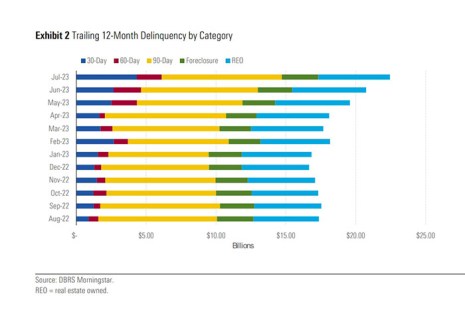

DBRS Morningstar, Toronto, reported the delinquency rate for loans packaged in commercial mortgage-backed securities surged 31 basis points in July. The special servicing rate rose for the fifth straight month, increasing 24 basis points during July.

Tag: DBRS Morningstar

CMBS Delinquency, Special Servicing Rates Increase

The commercial mortgage-backed securities delinquency and special servicing rates both increased in November, according to Trepp LLC and DBRS Morningstar.

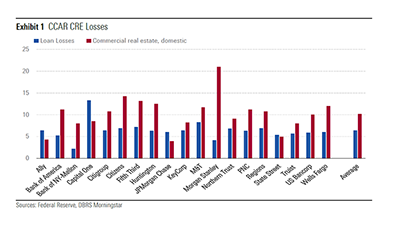

DBRS Morningstar: Federal Reserve Finds CRE Risk

The good news: all 34 banks the Federal Reserve’s recent stress tests examined passed. The not-so-good news: the tests found potential risks in certain loan portfolios including commercial real estate, said DBRS Morningstar, New York.

Tenant Quality Makes a Difference

Commercial real estate tenant quality grows even more important in a recessionary environment, reported DBRS Morningstar, Toronto.

DBRS: Hotel Pandemic Distress Less Than Prior Downturns

COVID-19 hit the hotel sector hard. DBRS Morningstar, Toronto, reported hotels had the highest loan modification rate among major property sectors due to the pandemic but said liquidations were lower than prior downturns.

Banks Trim Branches, Creating Empty Retail

Bank mergers and increasing online banking have led to numerous bank branch closings in recent years, which could have a “profound” effect on commercial real estate, said DBRS Morningstar, Toronto.

Ratings Agency Seeks Better Bank CRE Lending Disclosure

Better disclosures would allow rating agencies to better assess commercial real estate credit risk in bank loan portfolios, said DBRS Morningstar, Toronto.

Report Sees Potential Single-Family Rental Headaches

Single-family rental property fundamentals remain healthy, but there could be trouble on the horizon.

Report

Single-family rental property fundamentals remain healthy, but there could be trouble on the horizon.