CBRE, Dallas, said it expects the commercial real estate market to see a 16% increase in investment volume in 2026, nearly matching pre-pandemic levels.

Tag: CRE

LightBox: CRE Activity Remains Strong in July

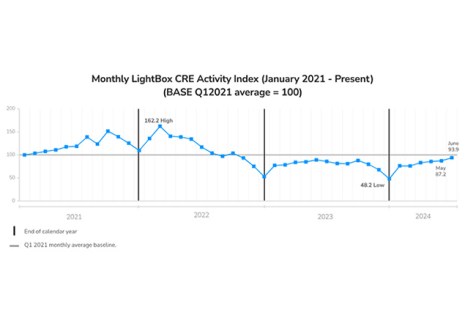

LightBox, Shelton, Conn., released its CRE Activity Index for July, pinning it at 112.4. That’s down just slightly from June’s high-water mark of 115.6.

LightBox: CRE Index Posts Strongest Reading Since 2022, but Outlook Uncertain

LightBox, New York, reported its Commercial Real Estate Activity Index rose sharply in March to 104.4, the highest level since June 2022 and only the second triple-digit reading in nearly three years.

LightBox Finds Slow Improvement in CRE Activity

The commercial real estate sector is adjusting to the fact that the Federal Reserve may lower interest rates only once this year–or possibly, not at all–according to LightBox, New York.

S&P Global Ratings: Life Insurers’ CRE Exposure ‘Manageable’

The credit quality U.S. life insurers commercial real estate exposure remains high, driven by the conservative, diversified nature of its investment in the space, according to S&P Global Ratings, New York.

MBA: Total Commercial Real Estate Borrowing and Lending Declined 47% in 2023

Total commercial real estate (CRE) mortgage borrowing and lending is estimated to have totaled $429 billion in 2023, a 47% decrease from the $816 billion in 2022, and a 52% decrease from the record $891 billion in 2021.

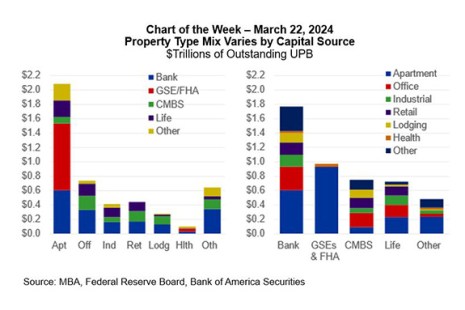

MBA Chart of the Week: CRE Mortgage Debt Across Capital Sources, Property Types

This week’s Chart of the Week shows MBA’s estimates of the distribution of CRE mortgage debt across capital sources and property types and is derived from a variety of public and private sources.

Sept. 14: Value of Surveillance in Managing CRE Credit Risk

Commercial real estate debt markets face a challenging environment with rising interest rates and secular headwinds creating a new set of winners and losers. Join MBA Education and industry experts …

CRE Basics: Introduction to Commercial/Multifamily Real Estate On Demand Aug. 7-30

MBA Education’s Introduction to Commercial/Multifamily Real Estate teaches the foundational concepts of commercial/multifamily real estate that impact property owners and lenders. During this course, participants learn the rights to ownership …

CRE Basics: Introduction to Commercial/Multifamily Real Estate On Demand Sept. 11-Oct. 4

MBA Education’s Introduction to Commercial/Multifamily Real Estate teaches the foundational concepts of commercial/multifamily real estate that impact property owners and lenders. During this course, participants learn the rights to ownership …