Trepp, New York, reported the commercial mortgage-backed securities special servicing rate dipped in July after peaking at a 12-year high in June.

Tag: Commercial Mortgage-Backed Securities

MBA NewsLink Roundtable: The Top CMBS Issues to Watch in 2025

Given the notable increase in securitized commercial real estate lending in 2024, MBA Newslink interviewed three CMBS executives for their perspective on the industry landscape in the new year. They cover CMBS issuance, credit ratings, loan originations, loan delinquencies and loan defaults.

Trepp Reports CMBS Delinquency Rate Dips

Trepp, New York, reported the commercial mortgage-backed securities delinquency rate dipped back below 5% in May.

Office Sector Drives CMBS Delinquency Rate Up Slightly: Trepp

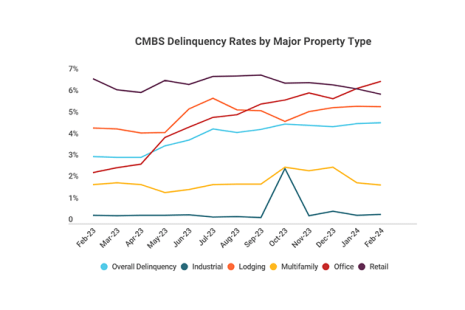

The delinquency rate for commercial mortgage-backed securities inched upward in February, according to Trepp, New York.

KBRA CMBS Outlook: Cloudy, With a Glimmer of Hope

Kroll Bond Rating Agency, New York, just released its CMBS 2024 Sector Outlook, which forecasts U.S. issuance activity for the new year and highlights key credit trends from 2023. MBA NewsLink interviewed KBRA’s Larry Kay and Andrew Foster to get their views on the current lending environment and property fundamentals as well as factors that may affect overall property performance in 2024.

Fitch Ratings: NOI Growth for CMBS Properties Sees Good 2022, but Slower 2023 Likely

Fitch Ratings, New York, reported property-level net operating income for loans securitized within Fitch-rated U.S. multi-borrower CMBS grew 6.3% in 2022, but warned that kind of growth likely won’t be sustainable this year.

Commercial/Multifamily People in the News June 22, 2023

Enterprise Community Partners, Columbia, Md., named Shaun Donovan its new CEO and President, effective Sept. 1.

MBA Education: Introduction to Commercial Mortgage-Backed Securities May 4

A critical component of commercial real estate financing, commercial mortgage-backed securities involve numerous industry participants, provisions and considerations with how the security is ultimately structured. Join MBA Education and industry …

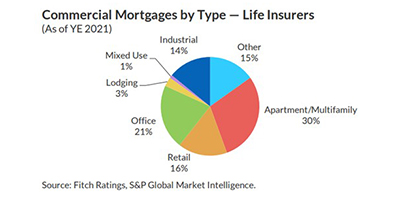

Fitch Ratings: U.S. Life Insurers’ Commercial Mortgages Stable Amid Growing Headwinds

Fitch Ratings, New York, said U.S. life insurers’ commercial mortgage fundamentals have largely recovered since the pandemic, with stable property outlooks for hotel, office retail and multifamily sectors.

KBRA: Servicers Performed Admirably During COVID

Kroll Bond Rating Agency, New York, said commercial mortgage-backed securities servicers “performed admirably” over the last two years while facing nearly unprecedented distress during the COVID pandemic.