Join MBA’s CMBS Committee and industry experts for a three-part webinar series exploring the latest trends and hot topics in commercial real estate finance, including agency and private-label securitization activities relating to CRE CLOs and bridge lending opportunities, multifamily dynamics across the country and New York City office market developments.

Tag: CMBS

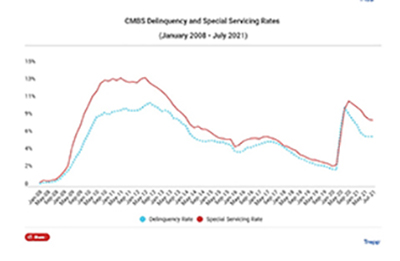

CMBS Delinquency, Special Servicing Rates Dip Again

“More of the same” was the commercial mortgage-backed securities delinquency rate headline in July, according to Trepp Senior Managing Director Manus Clancy.

Fitch Ratings: Environmental Factors Can Affect CMBS Large Loan Ratings

Fitch Ratings, New York, said a property’s environmental impact and sustainability may influence commercial mortgage-backed securities bond ratings in single-asset single-borrower and large-loan transactions.

CMBS Delinquency, Special Servicing Rates Improve

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined again in June–but not by much.

Most Senior CMBS Found ‘Resilient’ Under Stress Test

Most high investment-grade rated commercial mortgage-backed securities multi-borrower bonds can withstand downgrades under a new hypothetical stress test, Fitch Ratings reported last week.

CMBS Delinquencies Tick Up; Special Servicing Rate Drops

The commercial mortgage-backed securities delinquency rate and special servicing rate moved in opposite directions in April, two new reports said.

Introduction to Commercial Mortgage-Backed Securities May 19

A critical component of commercial real estate financing, commercial mortgage-backed securities involves numerous industry participants, provisions and considerations with how the security is ultimately structured. This MBA Education webinar will lay out the foundational concepts that everyone working in commercial real estate finance needs to know about CMBS and the CMBS market.

CMBS Market Musings: Trophy Asset, Transitional Loan Transactions Thrive

The private-label CMBS market remains a mixed bag, showing signs of a K-shaped recovery in the second quarter with delinquency and default numbers trending down now for nine consecutive months.

CMBS Delinquency Rate Falls Again

The commercial mortgage-backed securities delinquency rate fell once again in March and most CMBS rating actions were affirmations, analysts reported

MBA SVP Mike Flood Discusses March 10 CMBS Report: Coming Out of COVID

Mortgage Bankers Association Senior Vice President Mike Flood joined MBANow to discuss the March 10 Coming Out of COVID CMBS report.