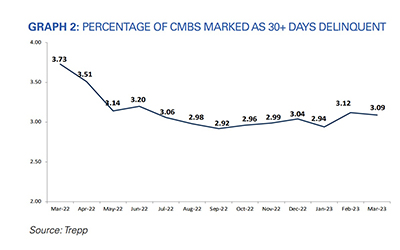

KBRA, New York, said the delinquency rate among KBRA-rated U.S. commercial mortgage-backed securities increased 19 basis points in November to 4.4%.

Tag: CMBS

CMBS Delinquency Rate Dips, KBRA Reports

The delinquency rate among KBRA-rated commercial mortgage-backed securities dipped four basis points in October to 4.21%, the rating agency reported.

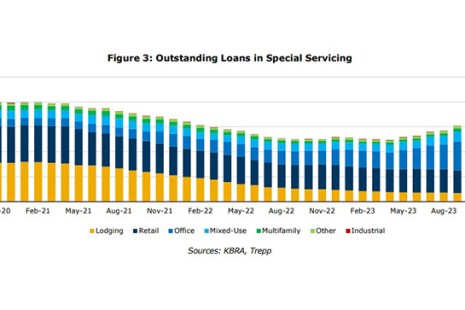

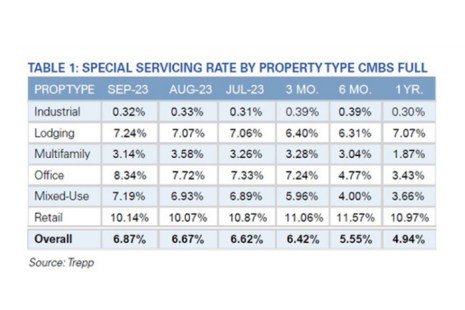

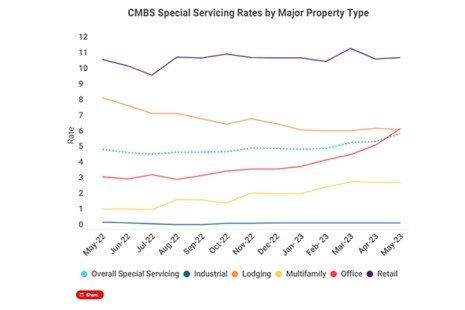

Trepp: Special Servicing Rate Climbs in September

Trepp, New York, reported the CMBS Special Servicing Rate increased by 20 basis points in September, up to 6.87%.

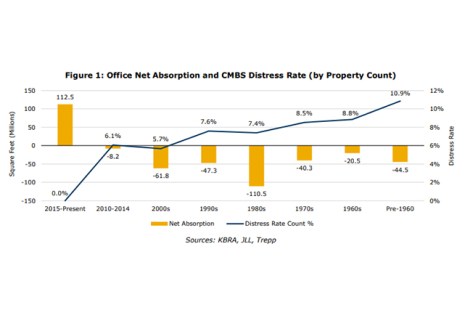

KBRA: Older Office Buildings Struggling

KBRA, New York, said in the current office environment, older buildings are seeing particular challenges.

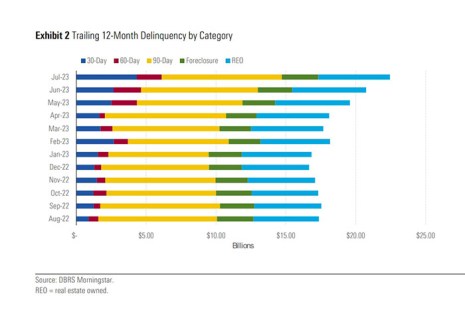

DBRS Morningstar: CMBS Delinquency Rate Surges

DBRS Morningstar, Toronto, reported the delinquency rate for loans packaged in commercial mortgage-backed securities surged 31 basis points in July. The special servicing rate rose for the fifth straight month, increasing 24 basis points during July.

Fitch Ratings: NOI Growth for CMBS Properties Sees Good 2022, but Slower 2023 Likely

Fitch Ratings, New York, reported property-level net operating income for loans securitized within Fitch-rated U.S. multi-borrower CMBS grew 6.3% in 2022, but warned that kind of growth likely won’t be sustainable this year.

Trepp: CMBS Special Servicing Rate Rises to 6.11%

Trepp, New York, reported its CMBS Special Servicing Rate climbed 49 basis points to 6.11% in May, marking its fourth sequential monthly increase.

CMBS Delinquency Rate Dips; Offices See Increase

The commercial mortgage-backed securities delinquency rate fell slightly in March, but the segment that everyone watches closely–office–saw its rate move higher again, reported Trepp, New York.

KBRA: Lodging Loan Performance Clouded by Upper-Upscale Chains

U.S. hotels have performed well overall since the pandemic, but upscale properties report higher commercial mortgage-backed securities delinquencies than more modest hotels, reported KBRA, New York.

Moody’s: CMBS Loss Severities Drop

Moody’s, New York, reported U.S. commercial mortgage-backed securities had the lowest loss amount last year since 2009, but noted loss severities remained elevated.