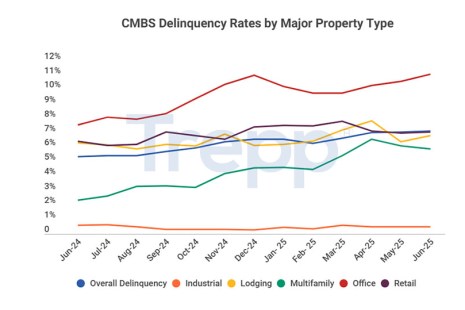

Trepp, New York, reported its CMBS delinquency rate rose 23 basis points in October to 7.46%.

Tag: CMBS

Fitch: CRE Refinancing Stability Underpinned by Resilient Debt Capital Markets

U.S. commercial real estate loan refinancing remains “resilient,” with ample liquidity absorbing this year’s elevated maturities, according to Fitch Ratings, Chicago/Toronto.

Trepp: CMBS Delinquency Rate Falls for the First Time Since February

Trepp, New York, released the September CMBS Delinquency Rate, finding that it fell six basis points to 7.23%. That’s the first drop since February.

Trepp: CMBS Delinquency Rate Increases for Sixth Straight Month

Trepp, New York, released its CMBS Delinquency report for August, highlighting that the rate increased for the sixth consecutive month.

Trepp: CMBS Special Servicing Rate Retreats Slightly After Three Increases

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate dipped in July after peaking at a 12-year high in June.

Trepp: CMBS Delinquency Rate Up; Office Hits High

Trepp, New York, reported that the CMBS delinquency rate rose in June, up 5 basis points to 7.13%.

CMBS Delinquency Rate Rises in April, Trepp Finds

Trepp, New York, reported its CMBS delinquency rate rose again in April, up 38 basis points to 7.03%.

Trepp: CMBS Delinquency Rate Jumps in March

Trepp, New York, reported the CMBS delinquency rate rose in March, with the overall delinquency rate up 35 basis points to 6.65%.

Trepp: CMBS Delinquency Rate Decreases in February

Trepp, New York, found the CMBS Delinquency Rate fell in February, with the overall rate decreasing 26 basis points to 6.3%.

KBRA Says CMBS Ended 2024 on High Note

KBRA, New York, reported commercial mortgage-backed securities ended the year on a high note, as issuance exceeded $100 billion in 2024—a level experienced only once since the global financial crisis.