CREF Policy Update: MBA Shares Housing Affordability Recommendations with Trump Administration Ahead of Upcoming Announcement

MBA Shares Housing Affordability Recommendations with Trump Administration Ahead of Upcoming Announcement

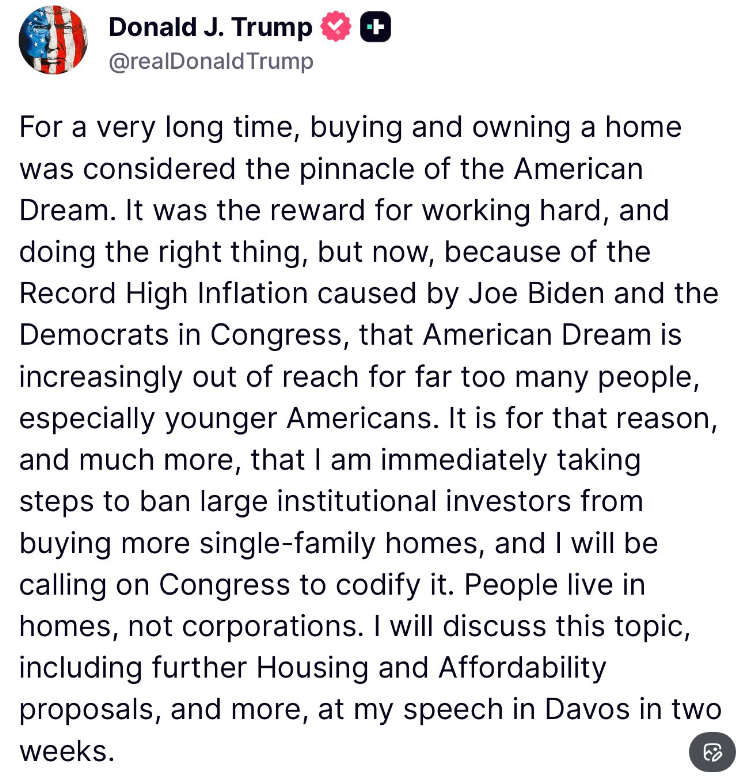

Ahead of an expected announcement in the coming weeks on “housing affordability policy actions,” President Donald Trump on Wednesday in a social media post (see image above) said that he is “immediately taking steps to ban large institutional investors from buying more single-family homes,” and that he will be “calling on Congress to codify it.”

And then on Thursday, the President announced, “I am instructing my Representatives to BUY $200 BILLION DOLLARS IN MORTGAGE BONDS. This will drive Mortgage Rates DOWN, monthly payments DOWN, and make the cost of owning a home more affordable.”

He also said that he will discuss affordability and more in his upcoming speech at the World Economic Forum’s (WEF) Annual Meeting on Jan. 19-23 in Davos-Klosters, Switzerland.

• Additional reporting, including from Politico, said that the White House is drafting an executive order on affordability, “including a push to allow people to dip into their retirement and college savings accounts to afford down payments on homes.”

• It is likely that some of the announced proposals, including a “ban on institutional investors purchasing single-family homes,” would require Congressional approval.

What they’re saying: In a statement shared with various media outlets, MBA President and CEO Bob Broeksmit, CMB, said, “MBA welcomes the Trump administration’s focus on making homeownership and rental housing more affordable and attainable for more Americans. We look forward to learning more about the Administration’s forthcoming proposals and have offered targeted recommendations to reduce housing costs. These include a potential reduction to FHA mortgage insurance premiums, reducing GSE loan-level price adjustments for middle-income buyers and for those seeking rate-and-term refinances, ending the tri-merge credit report mandate for lower-risk GSE-backed loans, reforming the mortgage loan originator compensation rule, improving construction loan options, seeking focused capital gains tax relief on the sale of a principal residence, and expanding condominium and multifamily lending through improved GSE and FHA policies.”

Why it matters: MBA continues to work meet with Administration and other officials to share recommendations that would help address affordability. Among the ideas MBA recommends for the multifamily market are the following:

• Support existing government multifamily lending and investment programs;

• Increase support and reduce complexity of the LIHTC program (Treasury);

• Reform the application of Davis-Bacon wage rates for FHA-insured multifamily financing (HUD/FHA);

• Reduce the mortgage insurance premiums for residential care facilities under the 232 LEAN program (HUD/FHA); and,

• Support a workforce or middle-income housing credit (Treasury).

What’s next: MBA remains actively engaged with the Administration and will continue working with the federal housing agencies and Congress to implement common sense policies and pass legislation – including a reconciled version of the House and Senate legislative housing packages (ROAD to Housing Act/Housing for the 21st Century Act) – that seeks to improve affordability for homebuyers and renters.

For more information, please contact Jamie Woodwell at (202) 557-2936 and/or Bill Killmer at (202) 557-2736.

MAA’s Next Quarterly Webinar: Jan. 29

With MBA’s National Advocacy Conference just a few months away, the Mortgage Action Alliance’s (MAA) upcoming webinar will spotlight this premier advocacy event, scheduled for April 14–15.

• Join MBA’s Legislative and Political Affairs Team to explore how national-level engagement strengthens state advocacy efforts and amplifies the industry’s collective voice. This quarterly webinar will feature a timely briefing on the year-end congressional closeout, an overview of the Q1 legislative agenda, and a look at MBA’s key policy priorities in this pivotal mid-term election year.

Why it matters: As our nation marks its 250th birthday, there’s no better moment than now to join hundreds of industry advocates and claim your seat at the table where meaningful change takes shape!

What’s next: Register for Part II of MBA’s State and Federal Advocacy Webinar & Fly-In Series, hosted by the California Mortgage Bankers Association, on Wednesday, January 21, at noon PT/3:00 PM ET. Part II will highlight the West and Midwest regions—but the session is open to MAA and MBA members nationwide.

For more information, please contact maa@mba.org or Margie Ehrhardt at (202) 557-2708.

Upcoming MBA CREF Council and Committee Meetings

MBA’s CREF Councils and Committees are a key way to connect to everything MBA has to offer around policy, advocacy, market intelligence and research, education, and networking. Councils and Committees are built around specific capital sources and serve as an opportunity for you to join other commercial real estate finance professionals to hear from experts, discuss opportunities and challenges, and connect with peers.

Upcoming virtual meetings include:

• FHA Council: Jan. 13

• Servicer Council: Jan. 15

• Private Credit Council: Jan. 21

• Insurance Company Council: Jan. 22

• All Council In-person Meet-up: Feb. 8

• Structured Finance Council (in-person): Feb. 10

For more information, click on the links above and/or contact Kelli Burke at (202) 557- 2742.

Upcoming MBA Education Webinars on Critical Industry Issues

MBA Education continues to deliver timely commercial/multifamily and single-family programming that covers the spectrum of challenges, opportunities, obstacles and solutions pertaining to our industry. Below, please see a list of upcoming and recent webinars – all complimentary to MBA members:

• External CMF Benchmarking Requirements – Jan. 14

• Distressed Asset Property Due Diligence and Tool Kit – Jan. 21

• Fundamentals of Commercial Insurance Issues and Problems – Jan. 27

• Internal CMF Benchmarking Requirements – Feb. 18

• Builder’s Risk Insurance Essentials for Commercial & Multifamily Properties – March 18

• Introduction to Commercial Mortgage-Backed Securities – April 8

MBA members can register for any of the above events and view recent webinar recordings by clicking here.

For more information, please contact David Upbin at (202) 557-2931.