JLL: Data Center Sector Enters Hyperdrive; Texas Poised to Dethrone Virginia as Global Leader

The data center sector has reached an inflection point as the sector’s extraordinary expansion fundamentally redraws the industry landscape, according to JLL, Chicago.

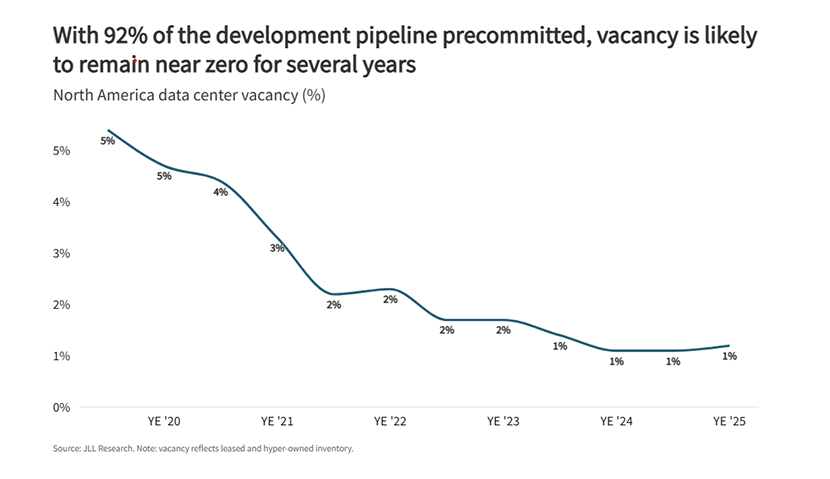

The firm’s new North America Data Center Report said the sector saw vacancy locked at a record-low 1% for the second consecutive year.

Nearly two-thirds of the 35 GW construction pipeline now extends beyond traditional mature markets and. As a result, Texas is positioned to overtake Virginia as the world’s largest data center market by 2030.

“The data center sector has officially entered hyperdrive,” said Andy Cvengros, executive managing director and co-lead of U.S. Data Center Markets with JLL. “Record-low vacancy sustained over two consecutive years provides compelling evidence against bubble concerns, especially when nearly all our massive construction pipeline is already pre-committed by investment-grade tenants.”

Cvengros noted this structural change is driven by hyperscale and AI demand and said development headwinds that will likely keep vacancy near zero for the next several years.

The report said available capacity remains limited to small, fragmented blocks, offering little flexibility for large-scale deployments. “Most tenants securing space today are contracting for deliveries in 2027 or 2028, underscoring the depth and durability of forward demand,” JLL said.

Texas Leads “Frontier Market” Surge as Geographic Boundaries Dissolve

More than half of the extraordinary construction volume is in “frontier markets,” which JLL defines as the markets outside traditional mature hubs like Northern Virginia, Dallas-Fort Worth and Silicon Valley. Texas alone accounts for 6.5 GW of capacity under construction, supporting projections that the state could overtake Virginia as the largest global data center market by 2030.

Other beneficiaries of this geographic transformation include Tennessee, Wisconsin and Ohio, which, like Texas, are capitalizing on abundant energy resources, ample land availability and business-friendly operating environments. Project scale has expanded sharply, with JLL tracking more than 10 projects of 1 GW or larger currently under construction, a threshold that would have been eye-opening just a few years ago.