U.S. Adds 177,000 Jobs in April; Industry Economists Weigh In

(Image courtesy of Bureau of Labor Statistics; Breakout image courtesy of Tom Jackson/pexels.com)

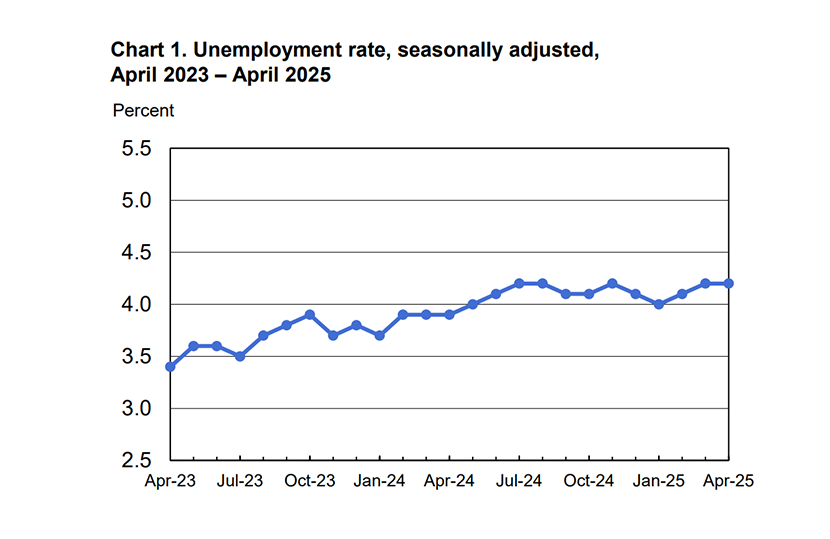

The U.S. Bureau of Labor Statistics reported that 177,000 jobs were added to total nonfarm payroll employment last month, with the unemployment rate flat at 4.2%.

Employment trended up in health care, transportation and warehousing, financial activities and social assistance. Jobs declined in the federal government.

The change in total nonfarm payroll employment for February was revised down by 15,000, from 117,000 to 102,000. For March, it was revised down by 43,000, from 228,000 to 185,000.

“In April, job gains were concentrated in just a few sectors, including health care and transportation and warehousing. We expect that transportation and warehousing jobs are at risk as the tariff effects kick in. Federal government employment decreased by 9,000 in April and is down 26,000 so far this year. Given the plans for further reductions, it is likely that this category will also shrink in the months ahead,” said MBA SVP and Chief Economist Mike Fratantoni.

“Despite the financial market volatility in April, and expectations of a sharp slowdown in economic activity in the coming months, these data will be enough to keep the Federal Reserve on the sidelines for now, as they assess whether the threat to economic growth or inflation is the bigger concern. Mortgage rates are likely to stay within their current range as well,” Fratantoni continued.

“The labor market’s resilience extends another month, with the April jobs report exceeding consensus estimates. With the labor market staying strong, the Federal Reserve will likely extend its ‘wait-and-see’ approach to further interest rate cuts as it assesses the impact of tariffs,” said First American Senior Economist Sam Williamson.

“Nonetheless, downside risks to payrolls remain, largely due to government layoffs and firms delaying hiring. Some firms are reportedly preparing for layoffs, but announcements remain scarce,” Williamson noted. “Meanwhile, lagging indicators, such as the February Job Openings and Labor Turnover Survey, show a steady weakening of demand for labor, with fewer vacancies and the lowest hiring rate in roughly a decade (outside the pandemic), though employers remain reluctant to cut jobs.”