JLL Sees ‘Double-Digit’ Medical Outpatient Building Growth on Horizon

(Chart and inset photo courtesy of JLL. Cover photo courtesy of Wutthichai Charoenburi via Pexels)

An aging population, surging outpatient demand and the need for services near growing populations are all contributing to strong demand in the healthcare sector, according to JLL, Chicago.

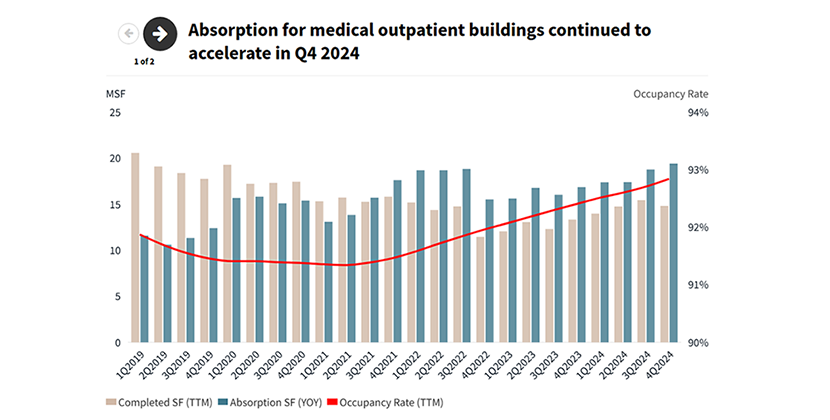

Healthcare consulting form Advisory Board, Washington, D.C., forecasts that outpatient volumes in the U.S. will grow 10.6% over the next five years. JLL’s new Medical Outpatient Building Perspective report examined the trends shaping the healthcare real estate landscape, including the accelerating move toward outpatient care, rising occupancy, limited construction for purpose-built MOBs, steady rent growth, demographics driving expansion in Sunbelt markets and medical buildings offering continued stability for investors and health systems.

“These findings reflect the ongoing transformation of the healthcare real estate landscape, driven by factors such as changing patient preferences, technological advancements and demographic shifts,” JLL Healthcare Division President Cheryl Carron said. “Health systems are taking a more active role in shaping their real estate portfolios and, along with corporate medical groups, are at the forefront of change, implementing ambitious ambulatory care strategies to improve patient outcomes and optimize their revenue streams.”

The report noted an aging population and increasing disease prevalence is driving the overall need for care. “The site of care shift from inpatient to outpatient will continue as technology and patient preference is driving advances in medical care, making treatments less expensive, safer and less invasive,” JLL said.

Health systems are expanding their real estate footprint and either acquiring or contracting with physician groups to add specialties, the report noted. From 2022 to 2023, 16,000 additional physicians became employees of a hospital system, and health systems accounted for 46% of MOB leases that JLL tracked in 2024. Specialty providers comprised 31% of the MOB leases, with psychiatrists and behavioral health providers making up the largest group of these, accounting for 18% of this square footage.

“We’re seeing a clear trend of hospitals and health systems focusing on high-value services such as orthopedic and cardiovascular care,” said Matt Coursen, Executive Managing Director and Market Leader of JLL’s Mid-Atlantic Healthcare Group. “These healthcare providers prioritize access, convenience and visibility for their outpatient locations, in some cases mirroring retail tactics to capture market share either via acquisition or de novo growth.”

Coursen noted healthcare providers’ site selection process is intricate and involves analysis of patient data, community demographics, care gaps, population growth, insurance coverage, referral networks and competitor proximity. “Hence, why it is more important than ever to have a data-driven ambulatory network strategy that aligns with the real estate portfolio,” he said.