RealPage Forecasts Continued Strong Demand for Apartments

(Cover photo credit: Mike Sorohan. Chart and Thumbnail photo courtesy of RealPage.)

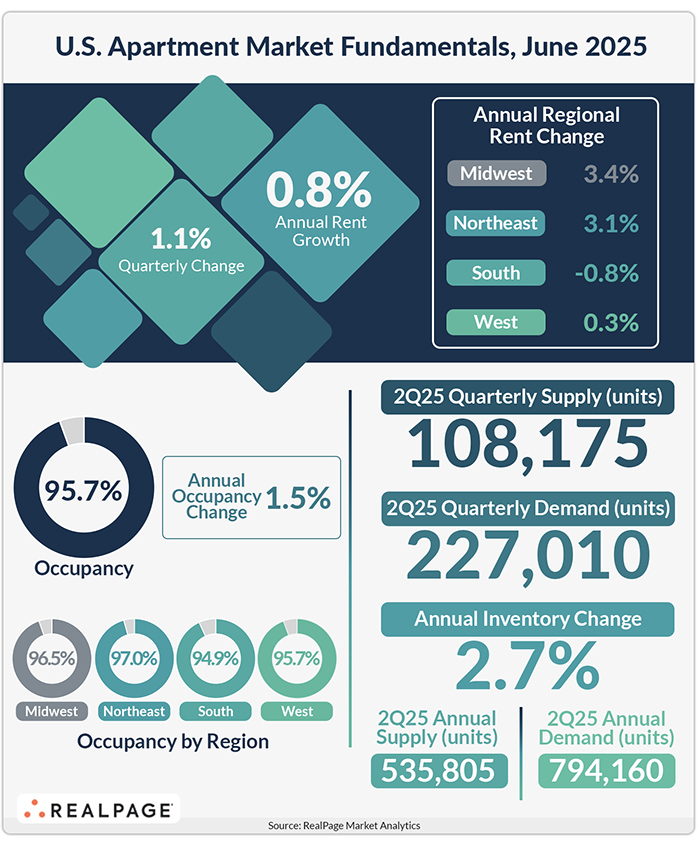

The pace of new apartment supply decelerated in the second quarter following a rapid decline in construction activity, according to RealPage, Richardson, Texas.

RealPage forecast strong demand for apartments in its second quarter analysis of the multifamily sector.

“Demand for apartments has shown remarkable resilience even as the once-in-a-generation supply wave crests and retreats,” RealPage Chief Economist Carl Whitaker. “We’re observing healthy absorption rates across the nation.”

Whitaker noted that while new supply is decelerating, “the total volume of new inventory delivering remains enough to satiate demand.”

RealPage said occupancy held steady at 95.7% in the second quarter, a modest year-over-year increase.

While average effective rents grew at a “muted” 0.8% rate year-over-year in the second quarter, markets with lower supply volumes, such as the Midwest, are seeing slightly stronger rent growth, the report said. Concessions remain elevated across most markets, with 20% of the units currently offering a concession with one-month free promotions.

RealPage reported rent growth remains strongest in regions with historically low supply volumes. It emphasized the growing disparity between limited vacancy coastal markets and supply-laden Sun Belt areas.

Rents have declined in 13 states over the past year, led by Arizona and Colorado with drops exceeding 4%. Both states rank among the top 5 for apartment inventory growth, behind only South Dakota, Idaho and North Carolina.