Auction.com: Foreclosure Auction Volume Up in Q2

(Image courtesy of Maria Orlova/pexels.com)

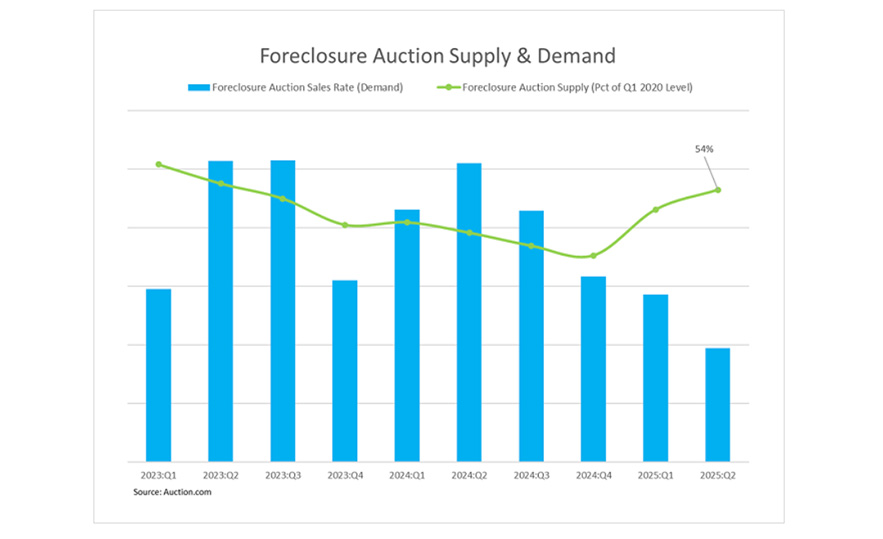

Auction.com, Irvine, Calif., released its Q2 2025 Auction Market Dispatch, finding that the supply of distressed properties available at auction continued to climb.

Completed foreclosure auctions were at 8,500, up 8% from Q1 and 19% from Q2 2024. That’s the highest quarterly total since Q2 2023 and 54% of Q1 2020 volume.

And, scheduled volume hit a two-year high at 36,331, 63% of the pre-pandemic benchmark.

REO properties brought to auction were up 10% from the previous quarter and up 20% from a year ago. They were also 43% of pre-pandemic levels.

Vacant REO auctions were up 31% year-over-year.

“The rise in vacant properties available to buy at auction is good news for the housing market because it means sellers are clearing out more aged inventory of unused, distressed housing stock that can now be transformed into much-needed housing supply by auction buyers,” said Ali Haralson, President at Auction.com. “It’s also good news for less experienced auction buyers, including even owner-occupant buyers, because these vacant properties are typically more accessible, allowing for interior access and not requiring the new buyer to deal with any current occupants.”

However, buyer appetite has also softened. The foreclosure auction sales rate fell 4% quarter-over-quarter and 12% year-over-year. REO auction demand also pulled back, with bidders per asset down 9% from Q1 and 21% year-over-year.

Winning bidders at foreclosure auctions paid 56.5% of estimated after-repair value on average, down from 56.9% in Q1 and 59.7% last year.

At REO auctions, the average bid-to-value ratio fell to 55.9%, down three percentage points from last quarter and six points from last year.

The bid-ask spread between what buyers were willing to pay and what sellers were willing to take widened for both foreclosure auctions and REO auctions.

Seller credit-bid pricing at foreclosure auctions fell 2 basis points quarter-over-quarter, but buyer price demand dropped 40 basis points, widening the gap. For REO auctions, sellers trimmed their reserve pricing by 129 basis points while buyers lowered their offers by 343 basis points.

And, sentiment in the July survey was mixed: 38% of Auction.com buyers said market conditions are making them less willing to buy, flat from Q1.

But, 37% say they plan to buy more auction properties in the next three months compared to the past 3 months, up from 33% in the previous iteration.