MBA Names Jamie Woodwell SVP of Commercial/Multifamily Policy and Strategic Industry Engagement

The Mortgage Bankers Association announced the promotion of Jamie Woodwell to Senior Vice President of Commercial/Multifamily Policy and Strategic Industry Engagement.

MBA Statement on FHFA and Treasury Amendments to the Preferred Stock Purchase Agreements

MBA’s President and CEO Bob Broeksmit, CMB, issued the following statement on the Jan. 2 Federal Housing Finance Agency (FHFA) and U.S. Treasury amendments to the Preferred Stock Purchase Agreements (PSPAs):

CREF Policy Update: FHFA Releases Annual Scorecard for Fannie Mae and Freddie Mac

Commercial and multifamily developments and activities from MBA important to your business and our industry.

Trepp Reports CMBS Delinquency Rate Rises Again in December

Trepp, New York, reported its CMBS delinquency rate rose in December, with the overall rate up 17 basis points to 6.57%.

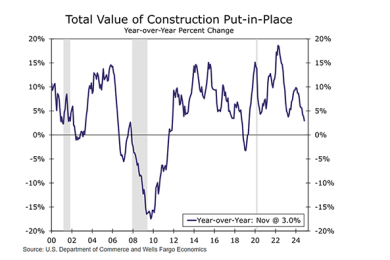

Construction Spending Holding Steady

November’s construction spending was virtually unchanged from the month before at a seasonally adjusted annual rate of $2,152.6 billion, the U.S. Census Bureau reported.

Single-Tenant Net Lease Sector Cap Rates Rise for 11th Quarter

Cap rates increased for the 11th consecutive quarter within all three sectors of single-tenant net lease properties in late 2024, per The Boulder Group, Wilmette, Ill.

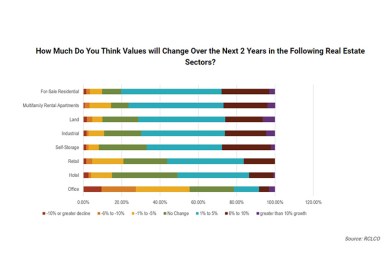

RCLCO: Sentiment Index in Recovery Territory

RCLCO, Bethesda, Md., released its Real Estate Market Index, finding that sentiment has moved solidly into recovery territory. The index ended the year at 64.8–and an RMI over 60 is typically indicative of positive or improving conditions, the firm says.

Dealmaker: Pace Loan Group Closes $35M C-Pace Loan in Missouri

Pace Loan Group, Minneapolis, closed a $35 million C-PACE loan for a studio complex in Chesterfield, Mo., a suburb of St. Louis.