Yardi Matrix: Industrial Sector Moderates in 2024

(Image courtesy of Yardi Matrix; Breakout image courtesy of Pixabay/pexels.com)

Yardi Matrix, Santa Barbara, Calif., found the industrial sector experienced stabilization in 2024 after a few years of running hot.

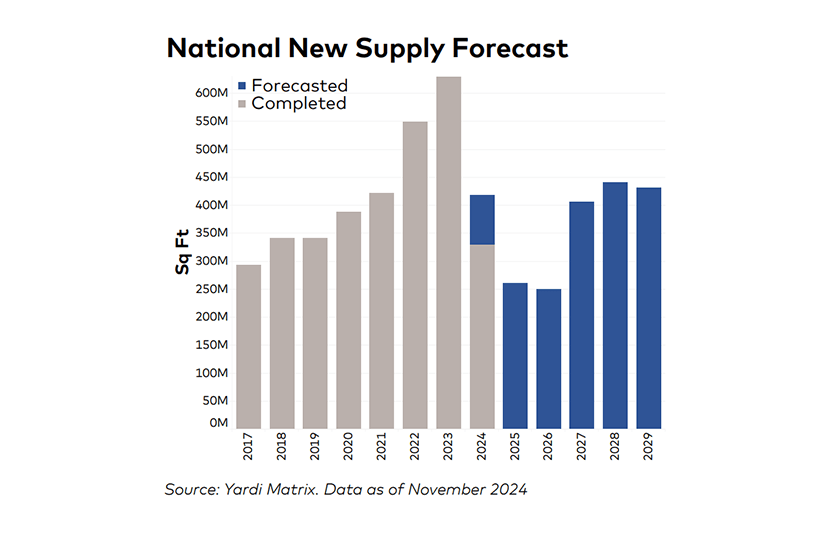

The significant wave of new supply began to cool down, as starts began to drop, demand for space moderated and higher borrowing costs made construction loans more expensive.

More than 1.1 billion square feet of industrial space were delivered between 2022-2023, but there were only 330.7 million square feet delivered through November 2024.

Currently 361.1 million square feet of industrial space, or 1.8% of stock, are under construction. The pipeline did grow for the first time this year, increasing 2.3 million square feet in November.

The national in-place rents for industrial space averaged $8.27 per square foot in November, up slightly from October and by 6.9% year-over-year.

The national vacancy rate has risen, sitting at 7.5% in November–up 30 basis points from October. The rate contrasts with 2022, when it was below 4% nationally and even tighter in some hot markets.

Through November 2024, there were $54.6 billion in industrial sales. There were $62.8 billion in 2023; Yardi Matrix anticipates the final 2024 numbers will come in close to 2023.

The average sales price of an industrial asset increased 2.7% through the year and sits at $128 per foot, compared with a 1.5% jump in 2023.

However, 2024’s prices gains weren’t as notable as 2021’s 25.6% year-over-year average sales price growth or 2022’s 13.5%.