Freddie Mac: Multifamily Originations, Rent to Rise in 2025

(Illustration courtesy of Freddie Mac)

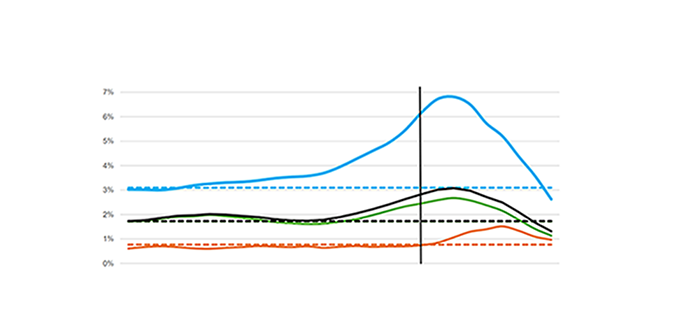

Freddie Mac, McLean, Va., forecasts multifamily originations will rise in 2025, while predicting modest rent growth and a slight increase in vacancy rates.

The new forecast notes that through the end of 2024, record-high supply kept market fundamentals muted despite strong demand. Meanwhile, elevated and volatile interest rates exerted downward pressure on property values. Freddie Mac’s research indicated that despite short-term pressures, multifamily will likely remain a favored asset class over the long term due to continued economic strength, demographic tailwinds and the lack of alternative housing options.

“Overall multifamily demand has been outstanding, but some areas are feeling the impact of the highest level of new supply since the 1980s,” said Sara Hoffmann, senior director of multifamily research at Freddie Mac. “We expect the multifamily market to continue to see subdued but positive growth in 2025, and for origination volume to increase as interest rates continue to stabilize — albeit at a higher level.”

The Outlook forecasts disparate performance across the nation, with many of the larger Sun Belt and Mountain West markets seeing very high levels of supply, causing performance to lag. Conversely, markets with lower supply levels, especially smaller, secondary and tertiary markets in the Sun Belt along with larger coastal and gateway markets, are expected to see stronger performance in 2025.

Freddie Mac forecasts rent growth of 2.2% for 2025. Although demand is expected to remain well above average in 2025, vacancy is expected to increase to 6.2%. The below-average rent growth and rising vacancy rates result in a forecast of gross rental income growth of 2% for 2025.