Commercial Real Estate Lending Rebound Continues, CBRE Finds

(Image courtesy of Ion Ceban/pexels.com)

Commercial real estate lending continued to rebound in the second quarter, though caution persists due to government policy and economic uncertainty impacting Treasury yields, according to CBRE, Dallas.

CBRE noted that “robust” activity from banks and alternative lenders supported activity in the second quarter.

The CBRE Lending Momentum Index, which tracks the pace of CBRE-originated commercial loan closings in the U.S., rose by 45% year-over-year. This increase came despite a 6% decline from the first quarter as tariff announcements and policy uncertainty weighed on borrowing conditions in April and May. The index rebounded strongly in June to close the quarter at a value of 275, well above the five-year pre-pandemic average of 229.

Commercial mortgage loan spreads widened to an average of 193 basis points in the quarter, up by 10 basis points compared to the same period last year and Q1 2025. Multifamily loan spreads narrowed by 22 basis points to 150 basis points, driven primarily by tighter agency loan pricing.

“Despite early challenges in the second quarter, the capital markets have demonstrated remarkable resilience and stabilization,” said James Millon, president and co-head of Capital Markets for CBRE. “Uncertainty surrounding tariffs and their potential impact on pricing and risk premiums initially caused a temporary pause in activity; however, as clarity improved and tariffs were delayed, credit spreads tightened to more balanced levels, and capital returned with risk-adjusted expected returns aligned to current market conditions. Industrial and multifamily assets, particularly those priced at a discount to replacement cost, continue to draw strong investor interest”.

Looking ahead, Millon noted he expects “sustained momentum” as market participants adapt to evolving conditions. “While headwinds persist, the strength and flexibility of capital markets, supported by robust pipelines, position us for continued growth in transaction volumes across both sales and debt,” he said.

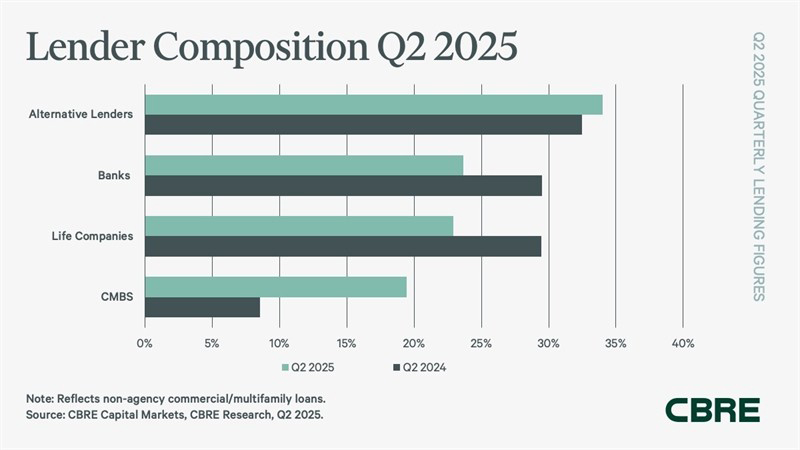

Alternative lenders, including debt funds and mortgage REITs, led CBRE’s non-agency loan closings in the quarter, capturing a 34% share, up from 32% in the same period last year. Debt funds drove much of this increase with lending volumes rising 89% quarter-over-quarter and 52% year-over-year.

Banks held the second-largest share of non-agency loan closings at 24%, a decrease from 29% a year ago. Despite the smaller market share, banks’ origination volume grew by 17%, indicating a strong reentry into the market.

Life companies accounted for 23% share of non-agency loan volume in the second quarter, down from 29% a year ago but up from 21% in Q1 2025.

CMBS lenders also saw increased activity, with their share rising to 19%, up from 9% a year ago. Lending volumes from CMBS lenders more than tripled year-over-year, fueled by active private-label CMBS issuance.

CBRE said government agency lending for multifamily assets reached $28.9 billion in the quarter, reflecting a 31% increase quarter-over-quarter and a 43% rise year-over-year. CBRE’s Agency Pricing Index, which tracks average fixed agency mortgage rates for seven- to 10-year permanent loans, fell to 5.7%, down 13 basis points from the previous quarter and by 28 basis points from the same period last year.