CRED iQ: Multifamily Distress Rate Up 80 Basis Points in February

(Image courtesy of CRED iQ; Breakout image courtesy of Pixabay)

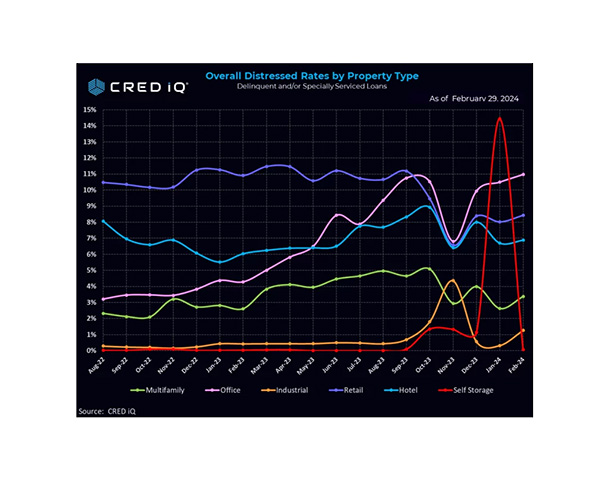

CRED iQ, Wayne, Pa., reported the Distress Rate for all property types trimmed 4 basis points in February to 7.35%. However, the multifamily distress rate was up 80 basis points–the largest monthly increase in that sector in more than a year and a half.

The overall distress rate has fallen 18 basis points over the past four months, with drops in three of those months. In February, the distress rate declined primarily due to a large self-storage portfolio ($2.1 billion) loan’s payment status becoming current, CRED iQ said.

The office sector claimed the largest distress rate at 11%, an increase of 47 basis points from the previous month.

The hotel segment’s distress rate increased by 20 basis points to 6.9%. Retail’s edged up 40 basis points to 8.4%.

Industrial and self-storage had very low distress levels of 1.3% and 0.1%, respectively.

CRED iQ’s Distress Rate aggregates the two indicators of distress–Delinquency Rate and Specially Serviced Rate. This includes any loan with a payment status of 30+ days or worse, any loan actively with the special servicer, and includes non-performing and performing loans that have failed to pay off at maturity.