MBA Chart of the Week: Expectations for the CRE Borrowing/Lending Market

(Image courtesy of MBA)

Even though many commercial real estate loans are long-lived, with terms of five, seven, 10, or more years, there’s a sense that the industry starts each year fresh. Sometimes, that means losing credit for all the deals and successes of the previous twelve months. Sometimes – like now – it means being able to put last year in the rearview mirror.

That fresh start may be one reason so many industry conferences are front-loaded in the year – with CREFC in early January, RER and NMHC at the end of January, and – most importantly – MBA’s CREF Convention at the beginning of February.

To prepare for the conversations at MBA’s CREF, every year MBA conducts its annual Commercial Real Estate Finance (CREF) Outlook Survey of senior leaders at top mortgage origination firms. This year’s survey showed an industry that remains hopeful but measured.

The median respondent expects originations to rise this year, with 21% expecting an increase of 5-10%, 47% an increase of 0-5%, 21% no change, and 10% a decline. Not surprisingly, more than 9 in 10 see the office market outlook as having a very negative impact but half see the industrial outlook as a positive.

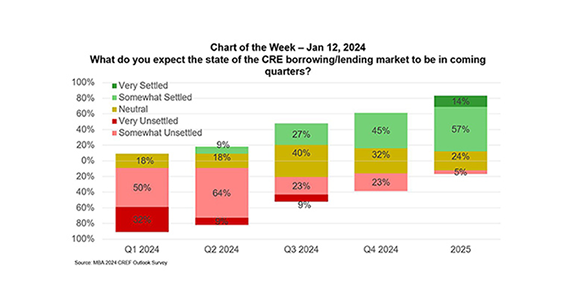

Most leaders don’t expect the market to turn around overnight. Four out of five (82%) expect CRE borrowing and lending to remain unsettled in Q1 of this year. That number slowly falls to one in four by the fourth quarter. Nearly two-thirds (61%) expect the markets to be settled by 2025.

There are competing narratives for commercial real estate in the coming year. The expression “stay alive ‘til ‘25” captures the zeitgeist of an industry that has fought through the pandemic, rising interest rates, the impacts of hybrid work, and more in recent years. But increasingly, we’re hearing an alternative – “do more in ‘24” – that sounds like many of the CRE professionals we expect to see in San Diego.

We’re looking forward to putting both on our bingo card for CREF 24.