Berkadia Finds Some Optimism in Commercial Real Estate Industry

(Image courtesy of Berkadia)

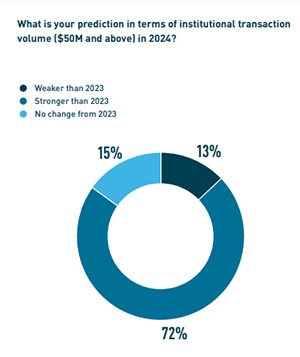

Berkadia, New York, released its 2024 Powerhouse Poll, revealing industry members’ perspectives on the commercial real estate industry. The survey found 72% of respondents believed institutional transaction volume will be stronger in 2024.

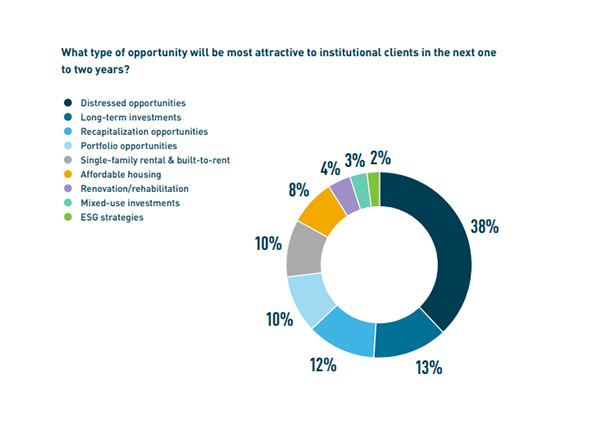

They expected institutional investors are most likely to seek distressed opportunities this year, followed by core and core-plus. By property type, respondents also believe distressed opportunities will be most popular among institutional clients over the next few years, followed by long-term investments and recapitalization opportunities.

Respondents anticipated that the GSEs will continue as the most active lending source this year, followed by life companies and the Department of Housing and Urban Development.

Private investors will lead in disposition activity and acquisition activity.

Responses were split on cap rates, with 35% believing they’ll be higher, 30% the same and 35% lower by the end of 2024.

Berkadia reported that investors will focus on the same three asset classes from 2023: Class A, Class B and true affordable housing. Outside of multifamily, the most attractive property sector is single-family rental and build-to-rent.

Locations that are the most attractive are primary suburban.

The poll queried respondents on solving the affordable housing crisis, with modifying tax policy, regulatory changes for GSEs and local and state government intervention receiving the top marks.

Office, retail and hotels/hospitality are believed to face the greatest challenges in 2024, and 97% said they expect to see an increase in distressed opportunities in 2024.

Respondents anticipated the impact of further innovation in 2024, including new technology such as Generative AI.

Compared with 2023, respondents believed demand will decrease, but were split on whether demand will outpace strong new supply.

Ninety-two percent said continued higher interested rates will impact investment transaction activity “significantly,” (50%) or “very significantly” (42%). About 60% say inflationary pressures will impact investment transaction activity in the year.

“Investors’ ability to navigate this challenging environment in light of anticipated, persistent headwinds through 2024 only reinforces our belief in the industry’s desirability,” said Berkadia Executive Vice President and Head of Production Ernie Katai. “While multifamily fundamentals may be cooling off in many markets across the U.S., we are encouraged by investors’ positive sentiment to pursue strategic opportunities, both equity and debt.”

The seventh-annual poll was conducted in December and collected insights from 212 Berkadia investment sales advisors and mortgage bankers across 70 offices.