Apartment Supply at 36-Year High in 2023, RealPage Finds

(Image courtesy of RealPage)

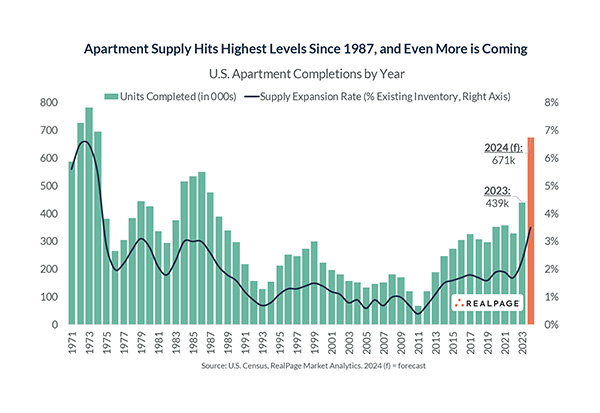

RealPage Analytics, Richardson, Texas, reported apartment supply jumped to the highest level since 1987 last year, largely due to the influx of construction projects begun a few years ago.

Almost 440,000 apartment units were completed in 2023, and even more are scheduled for 2024 (671,000 units)–although RealPage noted that 2025 will see a dramatic fall after recent slowdowns in construction starts.

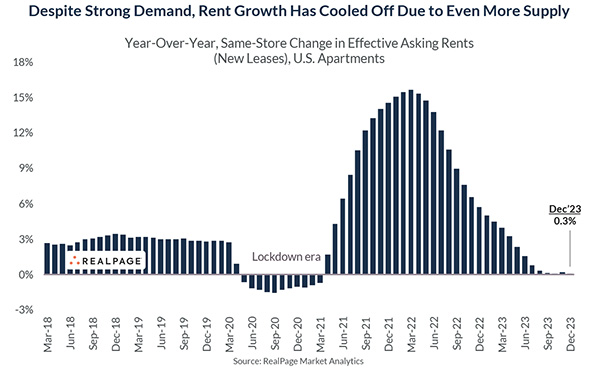

Simultaneously, rents flattened in 2023 after a stretch of high rent growth.

Rent growth was at 0.3% for the year, but rent growth levels are no longer decelerating.

And, demand rebounded in 2023, with Q4 2023 putting up surprisingly strong numbers. Net absorption was at 58,200 units, the third-strongest Q4 in 25 years (after 2020 and 2021.)

Net absorption for the full year was at 234,000–more in line with pre-COVID norms.

Given those relative supply and demand numbers, apartment occupancy fell 80 basis points year-over-year to 94.1%, but still within the long-term normal range.

“Furthermore, there remains a clear link between supply and rent change by market. Rents fell in 2023 across 40% of U.S. metro areas – and nearly all of those saw significant new supply entering the market,” wrote Jay Parsons, Senior Vice President, Chief Economist for RealPage. “By comparison, nearly one-third of U.S. metro areas produced rent growth of 3% or more in 2023, and nearly all of them had little supply to work through.”

It’s likely, Parsons noted, that 2024 will be another year of more supply than demand.