Redfin Reports Florida Condo Prices Falling as Insurance; HOA Fees Skyrocket

(Illustration courtesy of Redfin)

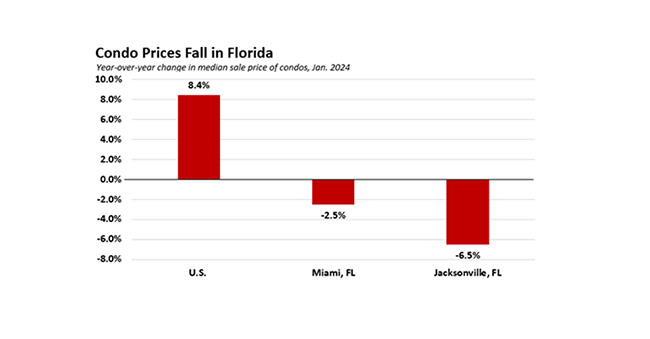

Prices of condos in some major Florida metros are dropping year-over-year and sales are declining as insurance costs and homeowners association fees climb, according to Redfin, Seattle.

That differs from the U.S. as a whole, where condo prices are rising, sales are holding steady and new listings are increasing at a much slower rate, Redfin said in a new special report.

In the Jacksonville metro, for instance, the median condo price declined roughly 7% year over year in January, sales declined 27%, and new listings increased 32%. The story is similar in Miami, where condo prices fell 3%, sales dropped 9% and new listings rose 27%.

Florida Redfin agents say climbing costs are making condo ownership less attractive. The average cost of homeowners insurance across Florida increased by about 40% in 2023 alone, and HOA fees are multiplying for many condo buildings. In addition to slowing demand, the rising cost of insurance and fees are pushing condo prices down, the report said.

While condo prices are down from a year ago, they’re still much higher than they were before the pandemic—an affordability challenge that’s being exacerbated by rising insurance and HOA expenses.

“Condo costs are shocking,” said Juan Castro, a Redfin Premier agent in Orlando. “Condos that used to have a $400 monthly maintenance fee may now have a $700 fee. It’s causing buyers to rethink their plans.”

Florida’s HOA fees are increasing because there are new condo regulations in place this year in the wake of the 2021 Surfside condo collapse. The regulations require HOAs to regularly assess the safety of condo buildings, and in many cases collect more money for maintenance and repairs. HOA fees typically include a condo owner’s portion of insurance costs for the exterior of a building, while homeowners have a separate policy covering the interior of their condo.

Home insurance costs are skyrocketing in Florida due to the increasing intensity of hurricanes and other natural disasters, with some insurance companies leaving the state altogether. Homeowners’ insurance costs three times more in Florida than the national average, making it the most expensive state in the U.S. to insure a home.

“Condos are sitting on the market much longer than they used to, with less interest from buyers,” said Jacksonville Redfin Premier agent Heather Kruayai. “Sky-high HOA costs are pushing buyers out of their monthly budget.”