CREF Policy Update Feb. 29: Fight for LIHTC! MBA’s National Advocacy Conference on March 19-20

REGISTER: Fight for LIHTC! MBA’s National Advocacy Conference on March 19-20; Separate CREF Track!

Join us in Washington, D.C. to meet with key policymakers, network with colleagues across the industry, and hear from policy experts on the topline issues impacting the industry – including a dedicated CREF track exclusively for our commercial/multifamily members. An exclusive reception will be held on Tuesday, March 19, at the National Museum of Women in the Arts. Lend your voice to our efforts and bring your expertise and experiences to the table.

Check out MBA’s group passes pricing.

Why it matters: Your participation at NAC ensures that members of the 118th Congress and other policymakers understand how proposed legislation affects your employees, your end users, and the communities you (and they) serve.

What’s next: MBA will continue to advocate on issues that impact the commercial/multifamily sector of the real estate finance industry.

For more information, please contact Jamey Lynch, AMP, at (202) 557-2818.

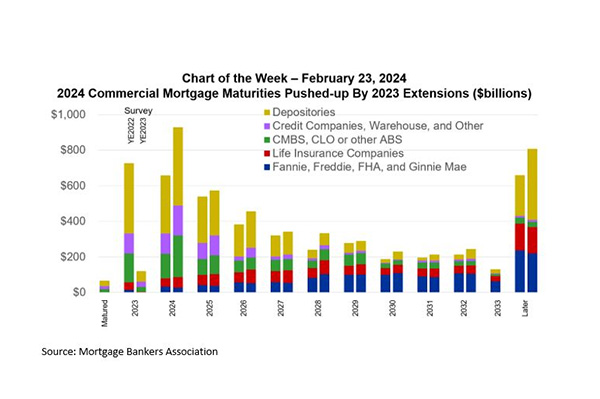

MBA Chart of the Week: 2024 Maturities Pushed Higher By 2023 Extensions

Commercial mortgages tend to be relatively long-lived, spreading maturities out over several years.

• A lack of transactions and other activity last year, coupled with built-in extension options and lender and servicer flexibility, have meant that many commercial mortgages that were set to mature in 2023 have been extended or otherwise modified and will now mature in 2024, 2026, 2028 or in other coming years.

• As a result, the amount of commercial mortgage debt maturing this year rose from $659 billion as of the end of 2022 to $929 billion as of the end of 2023.

Go deeper: MBA’s latest report on commercial mortgage maturity volumes showed that maturities vary significantly by investor and property type. Just $28 billion (3%) of the outstanding balance of multifamily and health care mortgages held or guaranteed by Fannie Mae, Freddie Mac, FHA and Ginnie Mae will mature in 2024. Life insurance companies will see $59 billion (8%) of their outstanding mortgage balances mature in 2024.

• $441 billion (25%) of the outstanding balance of mortgages held by depositories, $234 billion (31%) in CMBS, CLOs or other ABS and $168 billion (36%) of the mortgages held by credit companies, in warehouse or by other lenders will mature in 2024.

• By property type, 12% of mortgages backed by multifamily properties will mature in 2024, as will 17% of those backed by retail and 18% for healthcare properties. Among loans backed by office properties, 25% will come due in 2024, as will 27% of industrial loans and 38% of hotel/motel loans.

The big picture: The total $4.7 trillion of commercial mortgage debt outstanding is spread over a wide range of property types, capital sources, metro areas, submarkets, vintages, borrowers, and more. And, as designed, as a loan matures, owners — sometimes with lenders and servicers — will work through that deal’s particulars to determine how best to move it forward.

• No two deals are the same and, particularly now, broad brushstrokes about the CRE markets don’t apply.

For more information, please contact Jamie Woodwell at (202) 557-2936.

REGISTER: MBA’s State and Local Workshop on March 18-19

Join us in Washington, D.C. the day before the National Advocacy Conference begins to collaborate with industry peers on shared challenges and priorities and receive actionable advice to grow your state or local association’s member base.

Why it matters: In today’s challenging market, it’s more important than ever that state and local associations are helping members not just survive but grow.

What’s next: Take advantage of savings and maximize your impact when you register for both the State and Local Workshop and the National Advocacy Conference.

For more information, please contact Anthony Siller at (202) 557-2944.

Register: MBA’s mPact Summit on April 4 in Texas

Meet us in Texas for a full day of career development and networking on Thursday, April 4, 2024.

Back by popular demand, this event is built by – and for – young professionals in the real estate industry who are focused on helping you get to the next level.

Why it matters: Event topics include developing leadership skills, learning how to navigate your career, and building and practicing networking skills. You don’t want to miss this opportunity.

What’s next: Early bird registration ends on Feb. 29. Register now and save!

For more information, please contact Jacky Salazar at (202) 557-2746

Upcoming MBA Education Webinars on Critical Industry Issues

MBA Education continues to deliver timely single-family and commercial/multifamily programming that covers the spectrum of challenges, obstacles and solutions pertaining to our industry. Below, please see a list of upcoming and recent webinars – which are complimentary to MBA members:

• The Role of Public-Private Partnerships for Sustainable Affordable Housing and Community Development – March 5

• Private Credit Finance 201: A Deep Dive into Debt Funds and Their Impact to Commercial Real Estate Lending – March 6

• A Crisis of Identity in Lending – Best Practices for Securing the Borrower Experience – March 12

• Increasing Your Overall Productivity Through Special Purpose Credit Programs (SPCP) – March 13

• Who Are Today’s Borrowers? A Look at the Lending Preferences and Expectations of Today’s Consumers – March 14

• Making Sense of Multifamily Finance – March 14

MBA members can register for any of the above events and view recent webinar recordings by clicking here.

For any questions, please contact David Upbin at (202) 557-2931.