CBRE: Medical Outpatient Buildings Poised for Growth

(Illustration courtesy of CBRE)

The market for U.S. medical outpatient buildings is poised for lower vacancy and higher rents, leasing activity and sales transaction volume in 2025, according to CBRE’s 2025 U.S. Healthcare Real Estate Outlook report.

CBRE forecasts MOB asking rents will rise by up to 1.8% in 2025 and vacancy will decline slightly to 9.46% by the end of 2025 from 9.57% in this year’s third quarter. The firm also foresees lower interest rates, easing inflation and growing demand for healthcare services bolstering MOB leasing and sales activity next year.

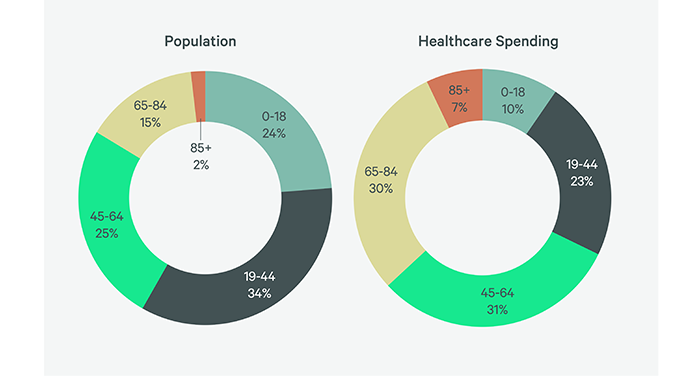

“The medical outpatient building market is propelled by long-term demographic and health care spending trends that sustain a rising trajectory,” CBRE Americas Healthcare Leader Bryan Johnson said. “This distinguishes the sector from other property types that are often affected by short-term economic cycles.”

Johnson said how, where and when healthcare services are provided evolves over time, “but it’s a certainty that the U.S. population will demand more healthcare services going forward.”

CBRE defines the MOB sector as buildings constructed for, or renovated to, house patient care outside of hospitals. This includes facilities for primary care physicians, dentists, behavioral clinics and other medical specialists. Also included are urgent care centers, surgery centers and addiction treatment clinics.

The anticipated gains in 2025 would come after a few volatile years for the MOB sector. The sector slowed in 2023 due to high interest rates and construction costs and a falloff in leasing of administrative space by large healthcare systems due to hybrid work. This year, the sector hit an inflection point amid the prospect of lower interest rates, growing demand for healthcare services, healthcare job growth and technological advancements allowing more medical procedures to shift to MOBs from hospitals.