Down Payment Resource Finds 9% Increase in Homebuyer Assistance Programs

(Image courtesy of Down Payment Resource; Breakout image courtesy of Los Muertos Crew/pexels.com)

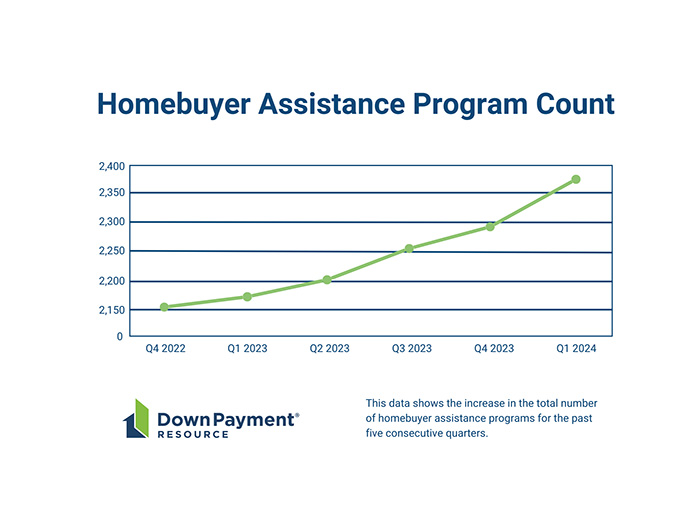

Down Payment Resource, Atlanta, reported that 79 homebuyer assistance programs were added in the first quarter, to hit 2,373 total. That’s an increase of 9% year-over-year and the largest annual jump since DPR began compiling the data in Q3 2020.

Additionally, DPR reported in its Homeownership Program Index that the number of agencies supporting the programs grew from 1,238 in the fourth quarter to 1,273 in Q1 2024.

There was growth in programs supporting affordable housing, including manufactured and multifamily units.

Currently, there are 856 programs available for manufactured housing, up 22% year-over-year. And, 647 programs allow for purchase of a multifamily property, up 9% year-over-year.

Per the report, 2,156 programs have income limits, but the number that don’t grew 11% from the last quarter of 2023 and 24% year-over-year.

There was a 108% year-over-year increase in below market rate/resale programs, from 37 in Q1 2023 to 77 in Q1 2024.

There are 192 programs designated as “incentive” programs, meaning they target a segment of homebuyers by their ethnicity or profession. For example, in Q1 2024 there was a 13% increase year-over-year in programs for Native American homebuyers.

In the quarter, there were 189 aimed at veterans, a slight drop from Q1 2023.

In terms of new programs added in the quarter, there were 17 new grant programs, 20 new combined assistance programs and five new deed restriction programs.

Overall, of the 2,373 homebuyer assistance programs: 82% are currently funded, 9% are currently inactive, 4% have a waitlist for funding and 6% are temporarily suspended.