CREF Policy Update Sept. 7: Bank Regulators Release Long-Term Debt and Resolution Plan Proposals

- Bank Regulators Release Long-Term Debt and Resolution Plan Proposals

Last Tuesday, federal bank regulators released a proposal that would require banks with at least $100 billion of assets to hold long-term debt to equal 6% of risk-weighted assets and 3.5% of total consolidated assets. For banks subject to the Supplemental Leverage Ratio, long-term debt must be greater than 2.5% of total leverage exposure. The regulators also released a proposal to require resolution plans for banks with at least $100 billion of assets.

• Why it matters: MBA and its members have concerns about the combined effect on multifamily and commercial lending of the forementioned rules, the recent release of the Basel III proposed capital rules, and last year’s proposed Community Reinvestment Act. Please see MBA President and CEO Bob Broeksmit’s, CMB, press statement on the Basel III capital rule proposal here, and MBA’s summary of the rule here.

• What’s next: MBA will work with its Bank Capital Task Force to analyze the proposals and better understand the implications for bank commercial and multifamily lending.

For more information, or to join the Bank Capital Task Force, please contact Mike Flood (202) 557-2745 or Megan Booth (202) 557-2740.

- MBA Chart of the Week: Multifamily Borrowing and Lending in 2022

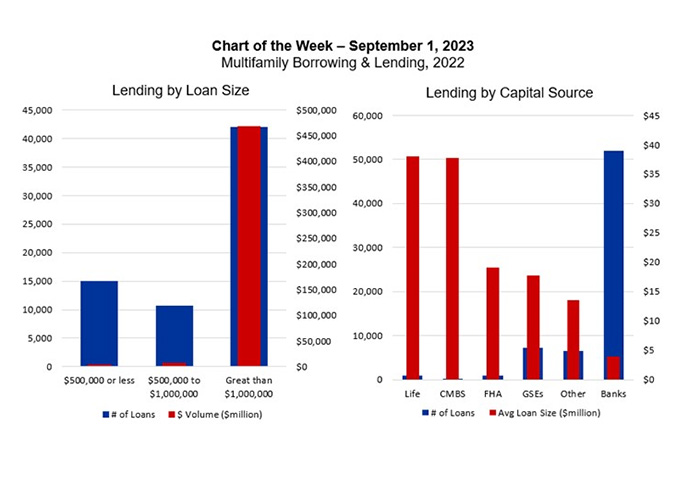

With more than $4.5 trillion of mortgage debt outstanding, commercial real estate finance markets are large and diverse. Much of the attention lately has been on the office sector, which accounts for $750 billion of that total. But a recent MBA report detailing lending activity supporting the nearly $2 trillion of multifamily mortgage debt outstanding provides key insights into the different roles played by different capital sources, and in particular how the bank sector is unlike many of the other lending sources.

Every year, MBA’s Annual Report on Multifamily Lending details borrowing and lending activity backed by multifamily properties. In 2022, it totaled $480 billion across 67,191 loans made by 2,242 lenders. The report tracks each lender, their total loan activity (by dollar and count), and their average loan size.

More than one-third of the multifamily loans that were made last year were for less than $1 million. Almost one-quarter were for less than $500,000. These loans are largely the domain of the banks. The average size of a multifamily loan made for a bank portfolio was $3.9 million, compared to averages of $38 million for life companies and CMBS, $19 million for FHA, and $18 million for Fannie Mae or Freddie Mac. The bank lending accounted for 77 percent of the loans (51,931 of the total 67,191) but just 42 percent of the dollar volume ($201 billion out of $480 billion).

In the current discussions about the impacts of CRE on banks, or of banks on CRE, it is important to note that the majority of loans made by the majority of lenders, particularly bank lenders, are not those that made the news headlines earlier this year. They are instead small loans backed by small properties, often owned by a local entrepreneur, and they are one of only a few multifamily loans that the lender made during the year (one-third of active multifamily lenders made 5 or fewer multifamily loans in 2022.)

The multifamily lending market – like the apartment market itself and CRE more broadly – is large and diverse, with different types of lenders playing in different parts of the market.

For more information, please contact Jamie Woodwell at (202) 557- 2936.

- California Rent Control Advocates Obtain Required Signatures for 2024 Ballot Initiative

Rent control advocacy groups in California have obtained the necessary signatures for their petition to be certified as valid by the California Secretary of State. Current California law (the Costa-Hawkins Rental Housing Act of 1995) generally prevents cities and counties from limiting the initial rental rate that landlords may charge to new tenants in all types of housing. It also limits rent increases for existing tenants in residential properties that were first occupied after February 1, 1995, in single-family homes and condominiums. This proposed measure for the 2024 ballot would repeal that state law and would prohibit the state from limiting the right of cities and counties to maintain, enact, or expand residential rent-control ordinances. This is the third time a coalition of advocates have attempted to pass a rent control measure, and each were previously defeated with significant industry mobilization and engagement.

• Why it matters: MBA and its members are opposed to rent control. MBA’s Broeksmit noted in a recent commentary that rent control only perpetuates the housing supply-demand disconnect.

• What’s next: MBA will coordinate closely with the California MBA, the Housing Solutions Coalition, and the Mortgage Action Alliance (MAA) to oppose this initiative.

For more information, please contact William Kooper (202) 557-2737 or Liz Facemire (202) 557-2816.

- Get Involved – MBA Advocacy Month Kicks Off in September

Join MBA’s Legislative and Political Affairs (LPA) team in September for MBA Advocacy Month, an all-member campaign focused on raising awareness on the top single-family and commercial/multifamily issues that can help produce positive policy changes at the national level.

• Why it matters: Throughout this month, MBA will work with members to engage with their employees and help run impactful Mortgage Action Alliance (MAA) and MORPAC campaigns. In addition, MBA staff will host (virtual) events, including legislative townhall(s) and webinars with a focus on how members can make their voices more effectively and better heard.

• What’s next: If interested in learning more and how to get involved, visit mba.org/advocacymonth.

For more information, please contact Jamey Lynch, AMP, at (202) 557-2818.

- Upcoming MBA Education Webinars on Critical Industry Issues

MBA Education continues to deliver timely single-family and commercial/multifamily programming that covers the spectrum of challenges, obstacles and solutions pertaining to our industry. Below, please see a list of upcoming webinars – which are complimentary to MBA members:

• Recent LO Comp Enforcement and Supervisory Activity – September 7

• Succeeding Today and Tomorrow: Tech Tools That Can Drive More Market Share – September 7

• Optimizing Technology in the Origination Process – September 12

• Budgeting and Financial Planning for Non-Believers – September 13

• Section 1071: A Practical Approach to Unpacking the CFPB’s Final Rule – September 13

MBA members can register for any of the above events and view recent webinar recordings by clicking here.

For more information, please contact David Upbin at (202) 557-2931.