MBA Chart of the Week: Commercial and Multifamily Mortgage Debt Outstanding

There’s a lot going on in the commercial real estate markets. Changes in property fundamentals, interest rates, property values, and more have led to a marked slowdown in transaction activity – with Q1 sales activity down 56 percent from a year earlier.

MBA’s Q1 commercial mortgage delinquency survey showed a 110-basis point increase in 30+ delinquency rates for office property loans. The Federal Reserve Board’s last Senior Loan Officer Opinion Survey (from January – before the recent focus on banks) recorded a net 58 percent of respondents tightening underwriting standards for commercial mortgages and 57 percent for multifamily mortgages. There is no doubt commercial real estate markets are experiencing a transition.

But two questions have dominated the CRE headlines of late: a) the reliance of banks on commercial real estate and b) the reliance of commercial real estate on banks. We addressed the former in a previous Chart of the Week. Here we look at the latter with a particular focus on office — the property type attracting the greatest scrutiny.

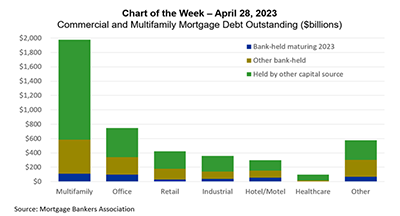

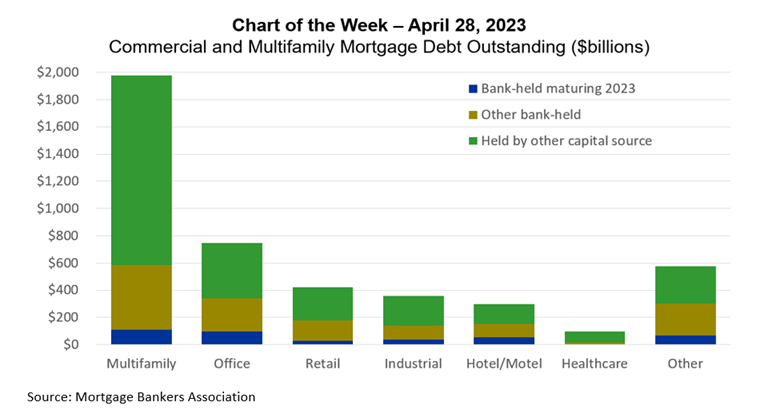

Out of $4.5 trillion of commercial and multifamily mortgage debt outstanding, multifamily accounts for nearly half – $2 trillion – followed by office – at $750 billion or 17 percent of the total.

Of that $750 billion of office-backed mortgages, we estimate that $339 billion is held by banks. That is 45 percent of all office-backed loans, 20 percent of all bank-held commercial and multifamily mortgages, and 8 percent of all commercial and multifamily mortgages.

Of that $339 billion of bank-held office-backed mortgages, $98 billion matures in 2023. That is 29 percent of all bank-held office-backed loans, 13 percent of all office-backed loans, 6 percent of all bank-held commercial and multifamily mortgages, and 2 percent of all commercial and multifamily mortgages.

The commercial real estate market is facing an unprecedented period of transition. Appreciating the wide range of properties, capital sources, vintages, and more is important to understanding just how impactful some of those transitions may be.

–Jamie Woodwell jwoodwell@mba.org.