Tech Sector Pressures Major Office Markets

(Courtesy CommercialEdge, Santa Barbara, Calif.)

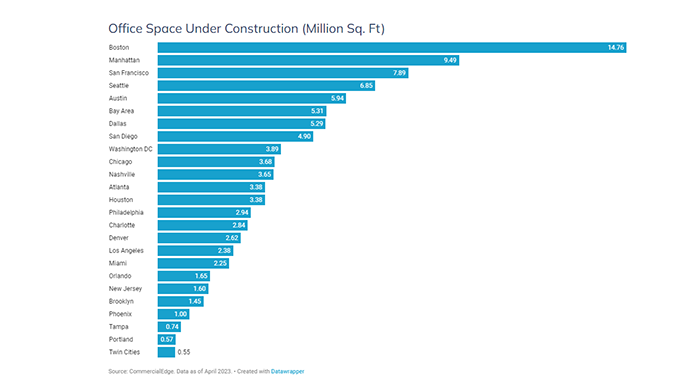

Office-using sectors added 67,000 jobs in April–a 2% year-over-year increase–but demand for office space remains weak across major markets, reported CommercialEdge, Santa Barbara, Calif.

“In an economic landscape full of challenges, the future of the U.S. office sector continues to be unsettled,” CommercialEdge said in its May National Office Report.

The national U.S. office vacancy rate has increased 100 basis points over the past year to 16.7%, CommercialEdge reported. “Tech layoffs and a large share of office tenants trimming their office occupancies continue to put pressure on some of the most established office markets in the country,” the report said.

Peter Kolaczynski, CommercialEdge Senior Manager, noted that as tech firms push to “right-size” their businesses, they put further pressure on availabilities by adding sublease space to the market. “Big Tech was the leader in committing to office deals during COVID, but occupancy still has not materialized for much of that space,” he said. “The societal relationship with office space continues to fundamentally change.”

CommercialEdge said metros once driven by a thriving technology industry are now disproportionately affected by the pullback of tech firms. For example, Austin, Texas saw its vacancy rate climb 5.8% year-over-year in April, while other tech hubs such as Seattle and Denver experienced 3.2% and 2.4% upticks over the same period.

“Weakening demand, coupled with repeated interest rate hikes and increased market volatility driven by the recent failures of Silicon Valley Bank, Signature Bank and Credit Suisse are expected to further drive uncertainty and put downward pressure on [office] sales,” CommercialEdge said.

CommercialEdge reported the national average full-service equivalent listing rate equaled $38.23 in April, a 2.3% increase over the past 12 months. Listing rates across A and A-plus office spaces stood at $46.89 per square foot, up 2.4% over year-ago figures. Class B office rates fell 0.2% to $30.26 per square foot and rates for Class C spaces decreased 1.1% to $22.80 year-over-year in April.