Institutional Investors Expecting Returns to Drop

(Courtesy Pension Real Estate Association, Chicago.)

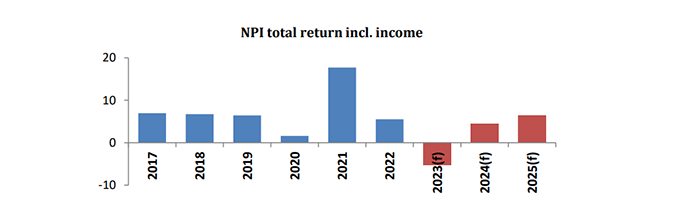

The Pension Real Estate Association, Chicago, said institutional investors expect the NCREIF Property Index of total returns to decline this year before bouncing back next year.

PREA surveyed investment managers and researchers about their expectations for unlevered institutional real estate returns represented by the NCREIF Property Index for its first quarter Consensus Forecast Survey. Respondents said they expect total returns across property types this year (including income) to decline by 5.3% this year and increase 4.5 percent next year.

MBA Head of Commercial Real Estate Research Jamie Woodwell noted market participants–whether buyers, sellers, owners, lenders or others–continue to work through questions about where things stand. “One of the biggest questions is around property values and how the changes and volatility in interest rates and yields have affected prices for commercial real estate,” he said. “A second, and related question, is around how different property types will fare. On the second question, apartment and industrial continue to be seen by many as the two most favored, and office as the property type with the most outstanding questions–although the broad brushstrokes with which all office properties have been painted may begin to give way to a more nuanced perspective.” Regarding property values, “it appears that many of the indices that track property prices have not yet caught up to what the market expects,” Woodwell said.