Fitch Lowers REIT Sector Outlook Amid Tighter Lending

(Courtesy Fitch, New York.)

Fitch Ratings, New York, lowered its U.S. real estate investment trust sector outlook to Deteriorating from Neutral.

In a credit market commentary, Fitch said the move reflects further tightening of commercial real estate lending conditions due to banking sector stress as well as ongoing pressure on valuations and fundamentals from higher interest rates and macroeconomic headwinds.

But most Fitch-rated REITs have the capacity to withstand such a slowdown within rating sensitivities. “Those with ample dry powder could capitalize on distressed property sales by weaker capitalized players,” the report said.

Bank lending represents roughly half of the $5.5 trillion commercial mortgage market and remains constrained, Fitch noted. Lending dropped by 20% between February and April. “Moreover, loan officers reported further tightening in April,” the report said. “At minimum, this will lead to further contractions in CRE credit, further limiting conditions for property transactions.”

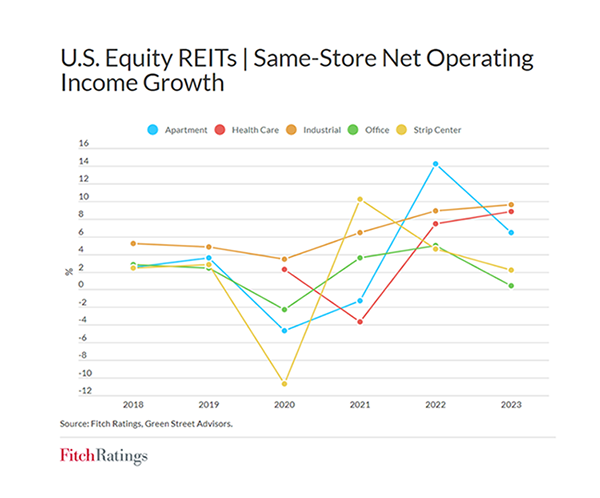

Fitch said it expects the U.S. to enter a recession this year, ending the generally favorable operating environment during the 2021 and 2022. “Our expectations for macro and fundamental trends are broadly unchanged since we established our 2023 Outlook last December,” the report said. “However, we have pushed out our forecast for a U.S. recession to late 2023 from mid-year and fundamentals for stronger performing property types have generally exceeded our expectations, while struggles are mounting for weaker performing sectors.”

Asset performance will likely vary widely by property type over the next two years, the report said. “Sectors experiencing strong fundamentals, such as industrial and shopping centers, will likely see some cooling in demand, with tenants showing greater reluctance to lease space, including delaying decisions, resulting in less pricing power for landlords. Tighter lending conditions and weaker economic growth will add to the secular pressures facing some property formats (e.g. office, enclosed malls).”