Zillow: Rent Growth’s Steady Slowdown Continues

(Courtesy Zillow, Seattle)

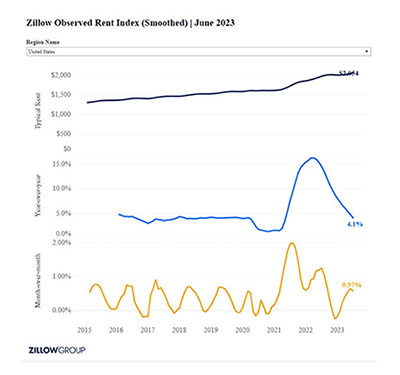

Apartment asking rents climbed by $12, or 0.6%, from May to June, reported Zillow, Seattle.

That brings the typical asking rent nationwide to $2,054, or 4.1% higher than one year ago, the Zillow Observed Rent Index found, continuing a steady slowdown in the annual growth rate since hitting a record-high 16.2% in February 2022.

Zillow noted the 0.6% monthly increase is virtually identical to the average June increase of 0.6% found between 2015 and 2019. “This perfectly average pace puts an end to seven consecutive months of below-average rent growth, showing a rental market that is finally on an even keel after swinging from very slow growth in much of 2020, to overheated growth in 2021 and much of 2022, back to cooler than normal this winter,” the report said.

Zillow Economist Jeff Tucker said the year’s midway point usually heralds a sharp cooldown in monthly rent growth. “Rent growth typically slows in late summer and often turns outright negative (if barely) in October and November,” he said.

So far this year rents have cumulatively risen 2.4%, while the average first-half cumulative growth before 2020 was 3.5%.

“Publicly available data give reason to expect continued sluggish growth,” the report said noting a record-high 978,000 multifamily housing units were under construction in May, at a seasonally adjusted annual rate. “As those apartments, which will mostly be rented out, come to market in the next one to two years, they will add to supply, which should suppress rent growth for existing units. The vacancy rate in rental housing has also begun to rise, from its lowest levels in almost three decades, observed in 2021 and 2022.”

Rents climbed especially quickly in the Northeast and Midwest, Zillow said. Rents rose the most on a monthly basis in Providence, R.I. (1.2%), New York City (1.2%), Chicago (1.1%), St. Louis (1.1%), and Washington, DC. (1.0%).

The slowest monthly rent growth was observed in May in Phoenix (no change), San Antonio (no change), Atlanta (0.1%), Portland, Ore. (0.1%) and Tampa (0.1%).

“The cooldown in official rent inflation is now well underway: The annual growth rate of the Rent of Primary Residence component of the Consumer Price Index fell from 8.80% in April to 8.66% in May,” the report said. “Moreover, the monthly growth rate is hovering around 0.5% (5.7% annualized), which if sustained will further pull down the observed annual growth rate, particularly measured against the high CPI readings from June to December last year. It takes time for that disinflation to fully factor into the monthly CPI prints, though, and thus the large shelter component in both CPI, and the Fed’s preferred Personal Consumption Expenditure price index, will contribute to the appearance of elevated inflation for several months to come.”