MBA: Commercial, Multifamily Mortgage Delinquency Rates Increase Slightly

Delinquency rates for mortgages backed by commercial and multifamily properties increased slightly during the second quarter, the Mortgage Bankers Association’s latest commercial real estate finance Loan Performance Survey reported.

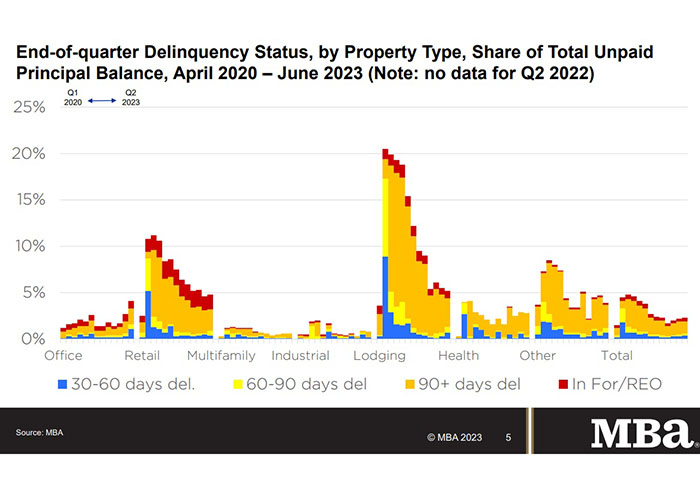

“Commercial and multifamily mortgage delinquency rates rose for the third straight quarter but with significant differences by property type,” said Jamie Woodwell, MBA’s Head of Commercial Real Estate Research. “Delinquency rates remain highest for lodging and retail loans, which have improved markedly but remain elevated as a result of pandemic-related impacts.”

Woodwell said delinquencies among mortgages backed by office loans drove the overall increase this quarter, with the office delinquency rate rising 130 basis points from 2.7 percent to 4.0 percent. By comparison, retail delinquency rates rose 30 basis points, multifamily loan delinquency rates were unchanged, and industrial and lodging delinquency rates declined.

“Recent volatility in interest rates, uncertainty around property values, and questions about some property fundamentals have led to a logjam in parts of the sales and mortgage transaction markets,” Woodwell said. “As loans mature, owners, lenders, and others will be working to identify the best path forward for each asset – which may help begin to break that logjam.”

Key Findings from MBA’s CREF Loan Performance Survey for June 2023:

The balance of commercial and multifamily mortgages that are not current increased in June 2023 (compared to March 2023).

- 97.7% of outstanding loan balances were current or less than 30 days late at the end of the second quarter, down from 97.8% at the end of the first quarter of 2023.

- 1.7% were 90+ days delinquent or in REO, down from 1.8% the previous quarter.

- 0.2% were 60-90 days delinquent, unchanged from the previous quarter.

- 0.4% were 30-60 days delinquent, up from 0.3%.

- Loans backed by office properties drove the increase.

- 5.3% of the balance of lodging loans were 30 days or more delinquent, down from 5.6% at the end of last quarter.

- 4.9% of the balance of retail loan balances were delinquent, up from 4.6%.

- 4.0% of the balance of office property loans were delinquent, up from 2.7%.

- 0.8% of the balance of industrial property loans were delinquent, down from 0.9%.

- 0.7% of multifamily balances were delinquent, unchanged from the previous quarter.

- Among capital sources, CMBS loan delinquency rates saw the largest increase.

- 4.1% of CMBS loan balances were 30 days or more delinquent, up from 3.3% last quarter.

- Non-current rates for other capital sources remained more moderate.

- 0.8% of FHA multifamily and health care loan balances were 30 days or more delinquent, unchanged from last quarter.

- 0.4% of life company loan balances were delinquent, down from 0.6%.

- 0.3% of GSE loan balances were delinquent, unchanged from the previous quarter

MBA’s CREF Loan Performance survey collected information on commercial and multifamily mortgage portfolios as of June 30, 2023. This month’s results build on similar surveys conducted since April 2020. Participants reported on $2.7 trillion of loans in June 2023, representing 59 percent of the total $4.6 trillion in commercial and multifamily mortgage debt outstanding (MDO).

Click here for more information on MBA’s CREF Loan Performance Survey.