CBRE: Rapid Global Data Center Growth Despite Power Supply Challenges

(Courtesy CBRE)

CBRE, Dallas, reported that power supply has struggled to keep pace with data center industry growth internationally. Per its Global Data Center Trends 2023 report, that’s continued to keep vacancies low and pushed rents in the sector up, even amid new construction.

“Strong demand for data centers is driving the increase in supply,” said Pat Lynch, Executive Managing Director for CBRE’s Data Centers Solution. “Still, we’re seeing low vacancy rates across the globe, particularly in North America, where vacancy is the lowest in a decade. We anticipate constraints on capacity and development to ease in the next few years, though it won’t entirely go away as an issue for the industry. As a result, operators and occupiers are expanding into new markets, which presents exciting opportunities for next-tier metro areas.”

Sourcing enough power is a top priority of data center operators in North America, Europe, Latin America and Asia-Pacific, with robust new development in those regions. However, vacancy rates are declining in all four regions due to strong demand.

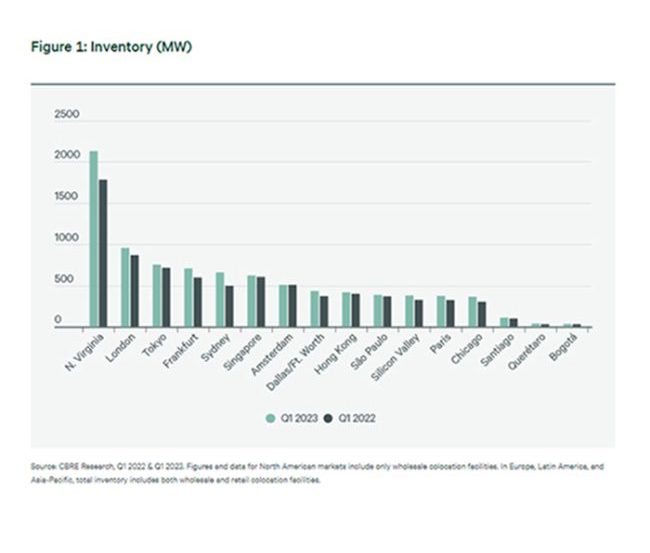

Northern Virginia, near Washington, D.C., is the world’s largest data center market.

Singapore has the highest rental rates at $300 to $450 a month for a 250- to 500-kilowatt requirement. Chicago is the lowest at $115-$125 for the same requirement.

(Courtesy CBRE)

Also on the radar: artificial intelligence, which–along with other power-dense technology–will continue to drive strong demand.

“Reliable power is a top priority for many data center operators and technology advances will increase this need going forward,” said Gordon Dolven, Director of Americas Data Center Research at CBRE. “New development is occurring across all regions despite limited power availability, yet large occupiers are finding it difficult to find enough data center capacity, giving impetus to emerging markets that have robust power supplies.”