Freddie Mac: Multifamily Market to Moderate

Freddie Mac, McLean, Va., said the multifamily market will likely continue to cool off this year.

Freddie Mac forecasts apartment rent growth will moderate, vacancies will tick up and loan originations will slow for the year. Property values are also expected to decline, but gross income growth will remain positive. Fundamentals should rebound slowly in the second half of the year as the market stabilizes.

“Volatile capital markets and a rise in the 10-year Treasury rate drove a contraction in multifamily lending in 2022 that will persist into 2023,” said Steve Guggenmos, Vice President of Research & Modeling for Freddie Mac Multifamily. “Economic uncertainty and rising prices have led to waning housing demand. This paired with elevated construction levels will drive rent growth to level off and eventually normalize.”

Guggenmos noted this environment is putting downward pressure on property values, “which have grown at a heightened pace in recent years,” he said.

Key findings from the Freddie Mac Multifamily 2023 Outlook:

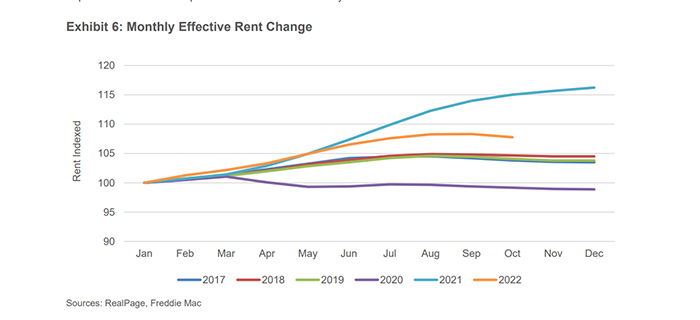

–Rent growth has moderated, and some data providers now indicate rents are declining on a monthly basis. Freddie Mac said it expects rent growth for 2022 to end the year between 6-8% year-over-year.

–Some data sources indicate vacancy rates increased throughout 2022, while others found very little change. Freddie Mac said it expects apartment vacancy rates to end 2022 up slightly over the prior year.

–For 2023, Freddie Mac expects multifamily fundamentals will start the year slowly but rebound in the second half of the year. The forecast projects gross income will increase 3.5% and the vacancy rate will rise modestly to 5.1%.

–Multifamily construction levels remain “extremely high,” the report said, which could put additional pressure on fundamentals in some markets.

— Freddie Mac said it expects the best performing markets to be predominately smaller southwestern and Florida markets. The bottom performing markets will likely be a geographically diverse mix of small and large markets, many of which are expected to see high levels of new supply.

–Throughout 2022, the 10-year Treasury rate was increasing and volatile, while cap rates held relatively stable. This caused multifamily cap rate spreads to compress. “This will put upward pressure on cap rates, which would put downward pressure on valuations,” the report said.

–Given broad economic uncertainty and volatile Treasury rate environment, Freddie Mac expects full-year 2022 multifamily origination volume will fall about 5.5% to $460 billion, with 2023 seeing a further decline of 4-5% to $440 billion.