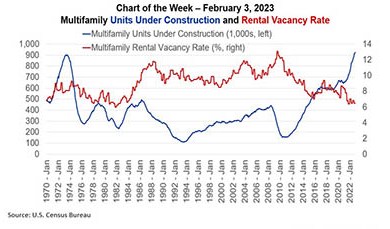

MBA Chart of the Week Feb. 9, 2023: Multifamily Construction/Vacancies

At the end of this week, many of us will begin our annual migration to San Diego and to MBA’s Commercial/Multifamily Finance Convention & Expo (CREF23). There will be no lack of topics to discuss – from return to the office, to the return of retail, and interest in cap rates to interest rate caps.

MISMO Recruiting Participants in New Group Focused on Building APIs for Commercial Data

MISMO®, the real estate finance industry standards organization, issued a call for industry professionals to join a new Development Workgroup focused on developing APIs for MISMO’s Commercial datasets.

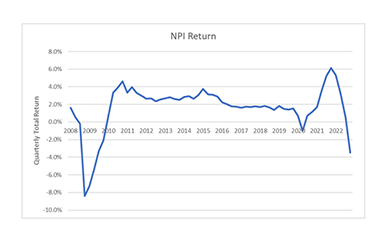

Largest Negative Returns for Institutional Real Estate Since Great Recession

The National Council of Real Estate Investment Fiduciaries reported institutional-quality commercial real estate returned -3.50% for the fourth quarter, the first negative return since the 2020 COVID pandemic and the largest since the Great Recession.

Dealmaker: Dockerty Romer Arranges $24M for Miami-Area Mixed-Use

Dockerty Romer & Co., Miami, arranged $24 million in permanent mortgage financing structured for Mayfair in The Grove, a mixed-use office and retail complex located in Coconut Grove, a neighborhood in Miami.

Investor Interest in Seniors Housing Upbeat for 2023

JLL Valuation Advisory Group, Chicago, said despite pricing uncertainties limiting capital markets activity, interest in seniors housing remains optimistic as investors seek higher yields from alternative asset classes.

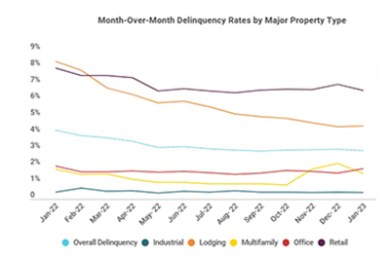

January CMBS Delinquency Rate Falls Below 3%

Trepp, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell 10 basis points in January to 2.94%.

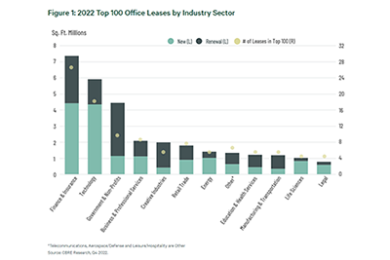

CBRE: Finance, Insurance Firms Signed More Large Leases than Tech Industry in 2022

The finance and insurance industry supplanted the tech industry last year for the largest share of the top 100 largest office leases in the U.S., reported CBRE, Dallas.

Green Street: Commercial Real Estate Fundamentals Healthy

Green Street, Newport Beach, Calif., reported commercial real estate fundamentals mostly proved healthy last year--except for the office sector--and will likely remain so through 2023.