CBRE Survey Points to Expectations of Commercial Real Estate Price Stabilization

(Image courtesy CBRE)

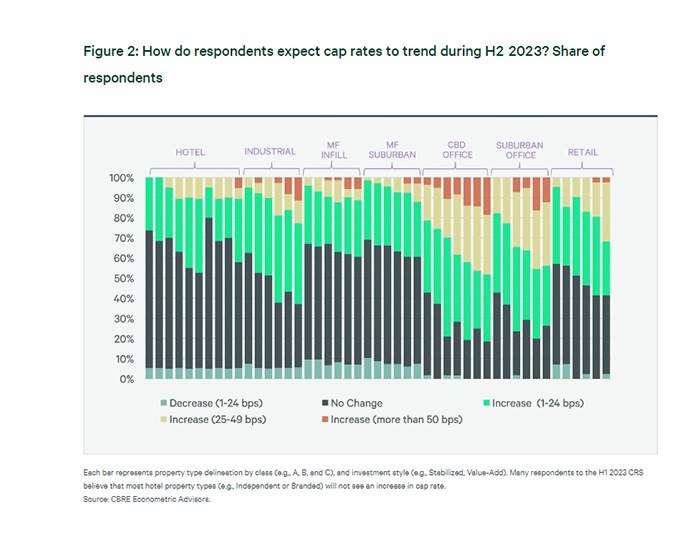

CBRE, Dallas, found in a survey that capitalization rates have begun to level off, and in a release said commercial real estate pricing appears poised to stabilize in the second half of this year.

“We are starting to see signs of stabilization in the investment market after a period of rapid cap rate increases,” said Tom Edwards, Global President of Valuation & Advisory Services for CBRE. “If inflation stays under control and the Fed does not continue to lift rates, investor confidence should improve, leading to more stable pricing and increased liquidity by mid-2024.”

CBRE found retail cap rates rose the least. Multifamily and industrial cap rates both expanded modestly. And, office cap rates increased the most, which CBRE pinned to investors seeking larger discounts as challenges persist for the sector.

The survey’s finding that yields are likely to stabilize is a clear reversal from the survey conducted in the second half of 2022.

Investor interest is gaining traction in the multifamily sector, CBRE found, and the hotel and retail sectors are strengthened by expectations for consumer spending.

CBRE’s U.S. Cap Rate Survey H1 2023 (CRS) was conducted in late May through early June 2023 and reflects transaction activity in the first half of 2023. CBRE noted that given rapidly changing capital market conditions, estimates may not reflect the most current market conditions.