Declines Persist in Institutional Property Values

(Industrial property in Catawba, N.C. Photo courtesy Cushman & Wakefield.)

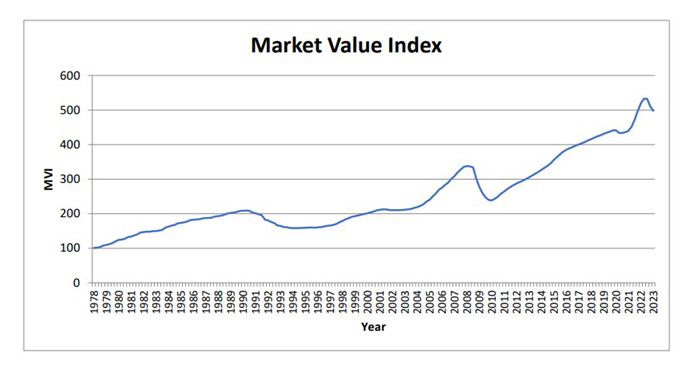

The National Council of Real Estate Investment Fiduciaries, Chicago, said its quarterly Property Index showed aggregate market values of properties declined for the third straight quarter; returns were negative for the second straight quarter.

The report said the market value index declined by 2.6% during the first quarter and the total return for the quarter was -1.81%. Although the return was negative, it was less negative than the -3.49% return during the 4th quarter and the decline in value was less than it was in the fourth quarter. The quarterly return consisted of 1.01% from income and -2.82% from negative property appreciation.

The -1.81% return is the unleveraged return for “operating properties” held by institutional investors throughout the U.S. As of quarter-end there were 4,717 properties with leverage and the weighted average loan to value ratio was 43%.

The report said lower unleveraged returns coupled with higher interest rates magnified the negative return for those properties with leverage. Properties with leverage had a total quarterly return on equity of -4.19%. The average interest rate on the leveraged properties rose to 4.71% for the first quarter, up from 4.34% in the fourth quarter. A handful of properties had values which were equal to or less than their loan balance and a few properties were returned to the lender.

The report said retail properties, which have struggled for several years relative to the other property sectors, managed a positive return of 0.52% for the first quarter, while hotels had a positive return of 2.30%. Office properties had the lowest return at -4.06%, followed by apartments at -2.10%. Industrial properties, consisting mainly of warehouse properties that experienced very strong performance for many years, had a negative return of -0.82%.

The report also said market value weighted capitalization rates based on appraisals for unsold properties in the index increased to 4.19% from 4.03% in the prior quarter. The report noted while there are relatively few properties that are sold each quarter, for those properties that did sell, the average cap rate was significantly higher at 5.61%. NOI growth was “surprisingly” positive at 2.3% during the first quarter.